Grain stored on-farm can now be sold on CGX

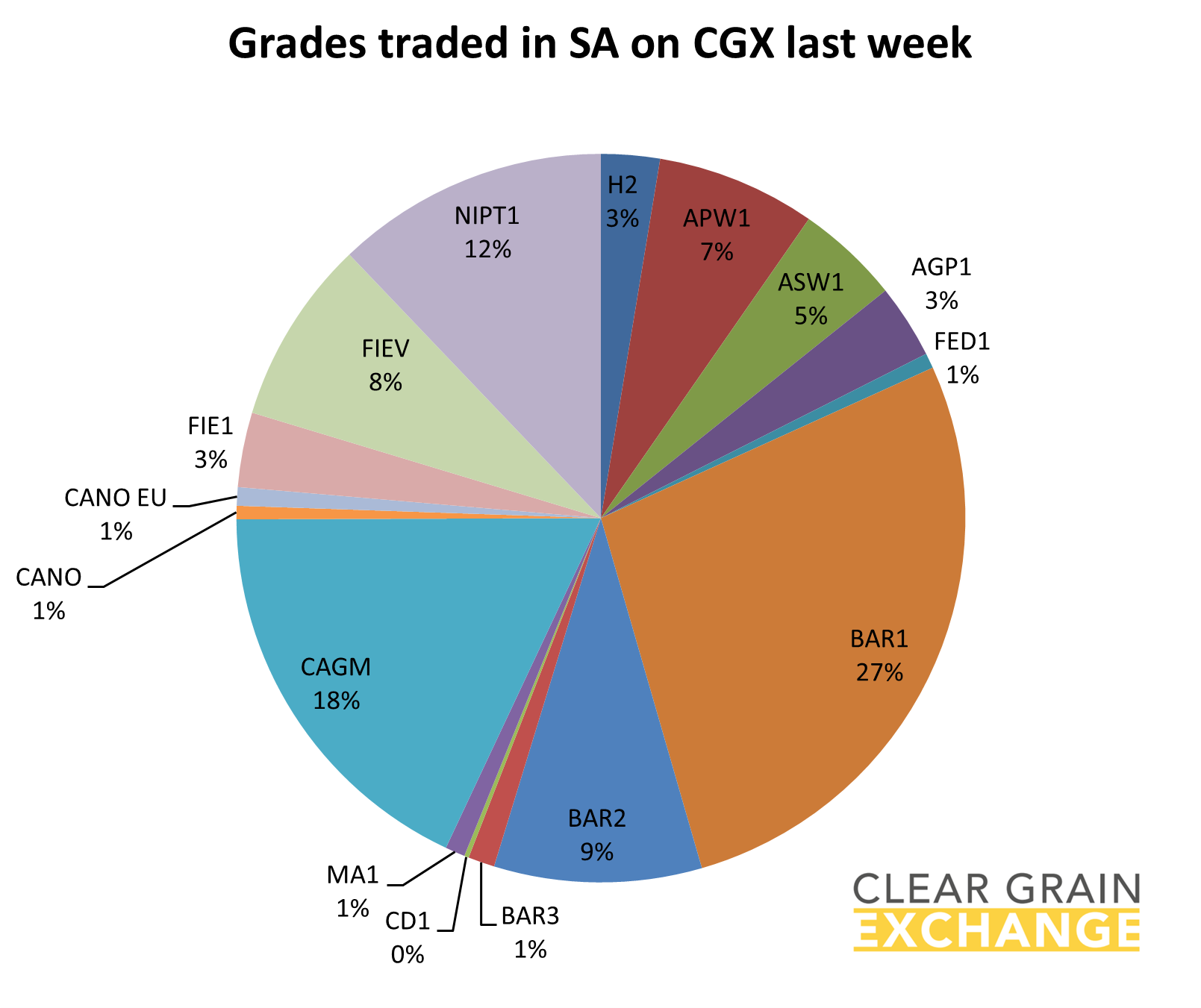

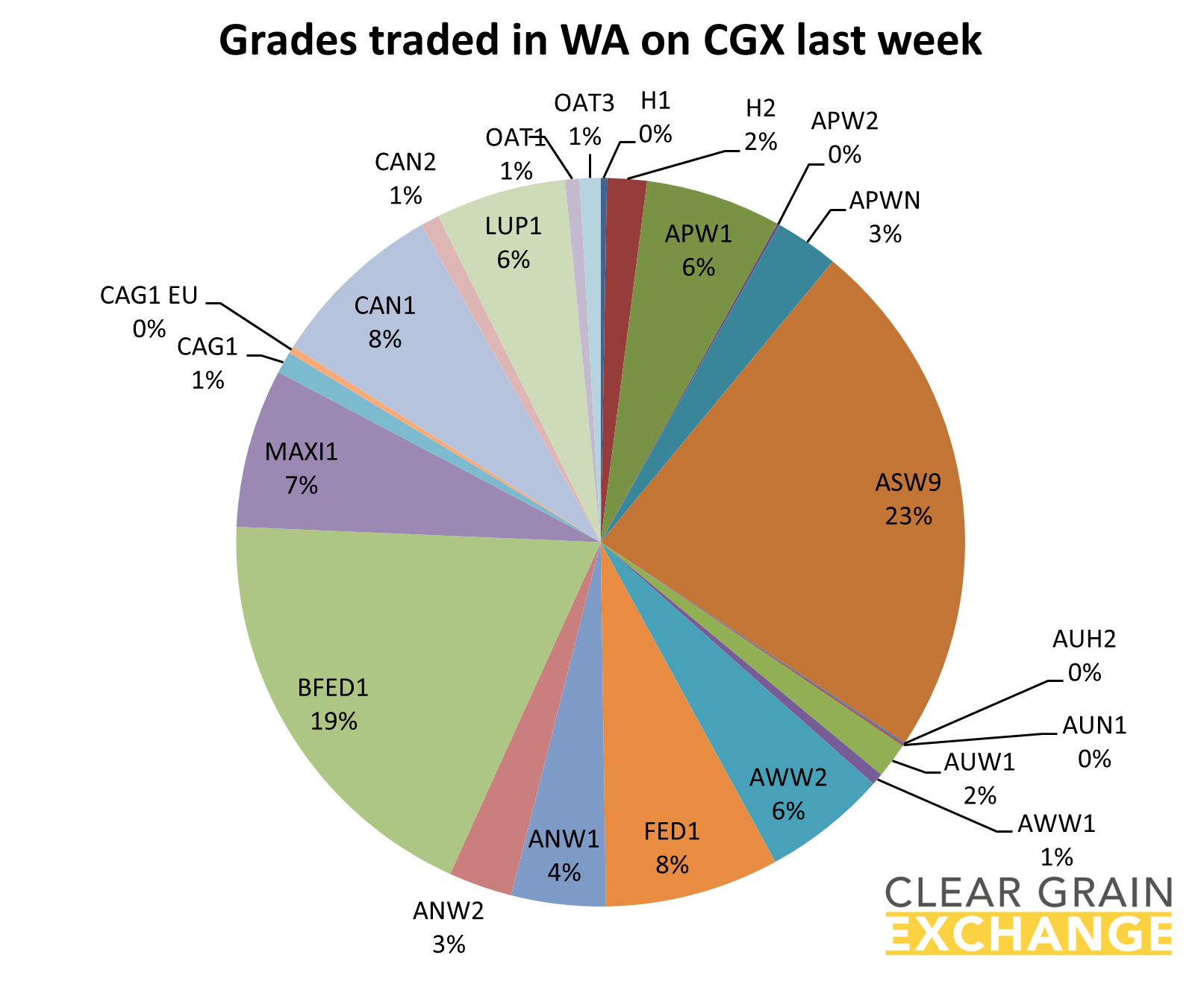

Pockets of demand create opportunity - 44 grades of wheat, barley, canola, pulses and sorghum traded across 15 port zones.

See prices traded + more firm bids at better values than cash bids - There is regularly more value than advertised cash bids - growers setting prices.

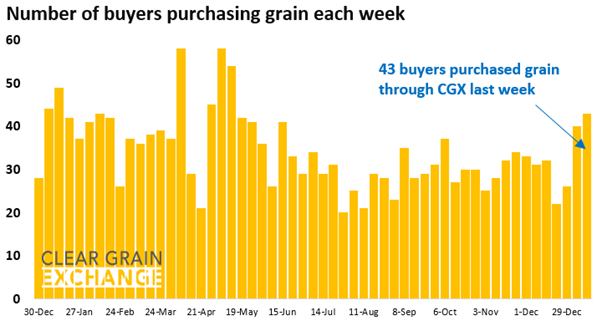

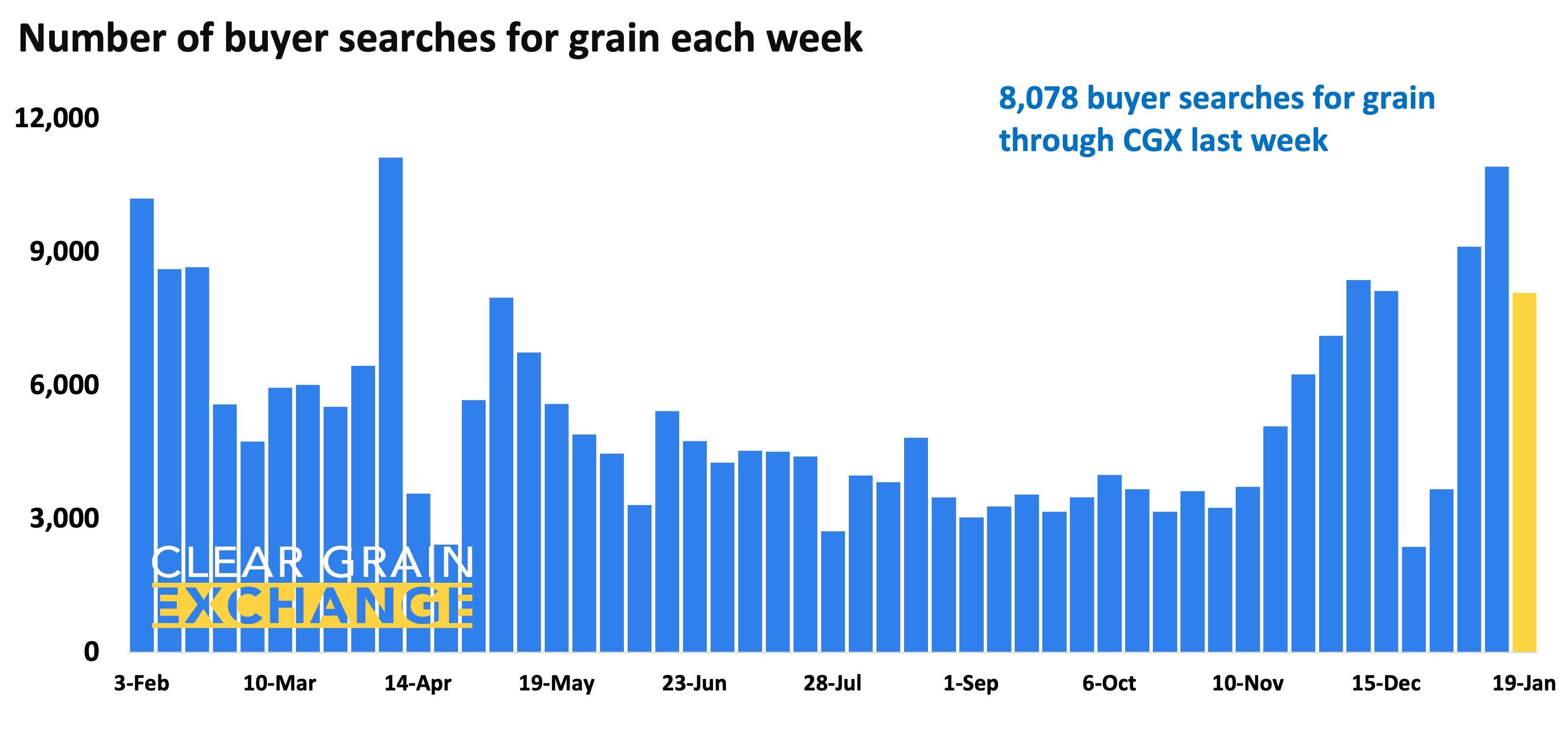

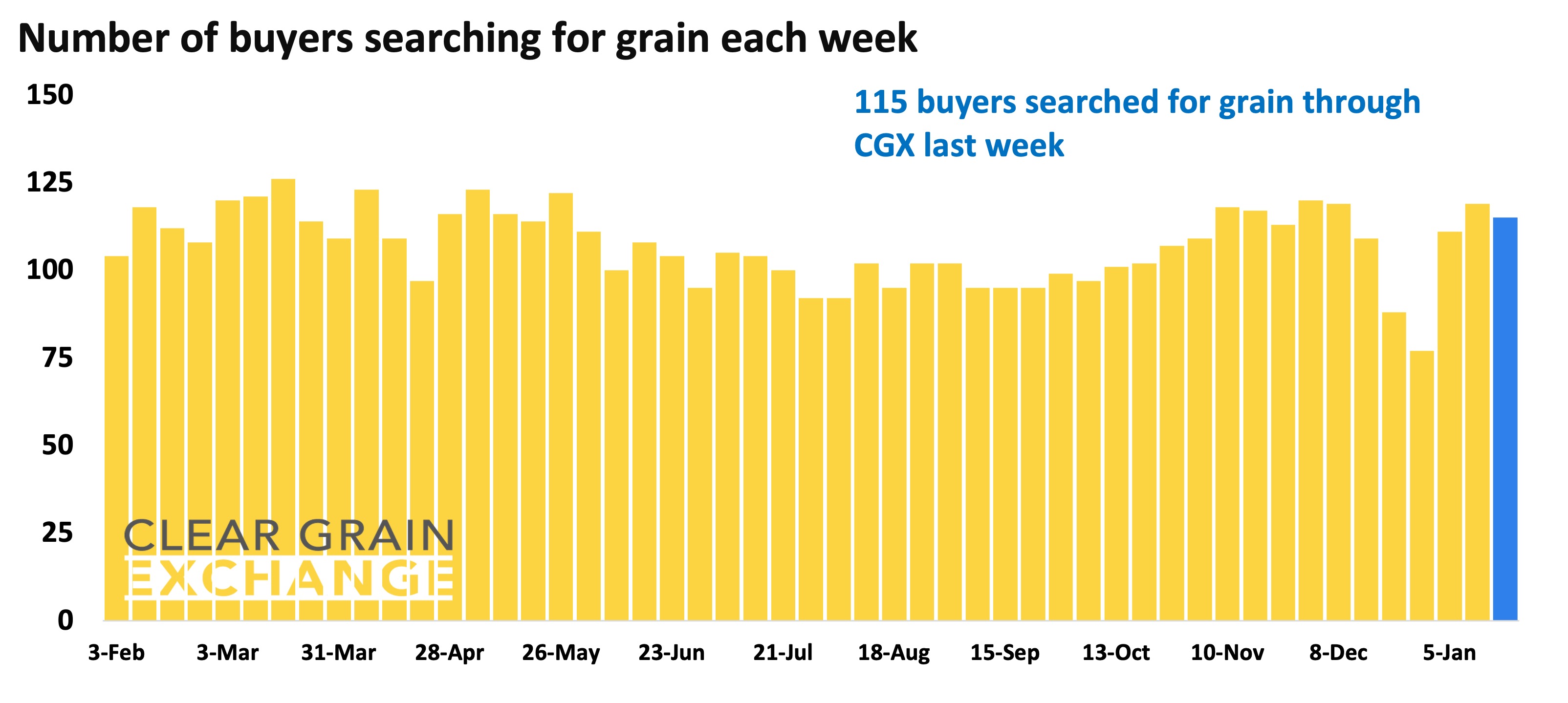

Plenty of buyers searching for grain - 115 buyers made 8,078 searches for grain offered for sale. 46 buyers were bidding for grain.

When your grain is offered for sale on CGX all buyers can see it and try to purchase it.

Market stats for last week

42 buyers purchased grain on CGX - more were searching for grain

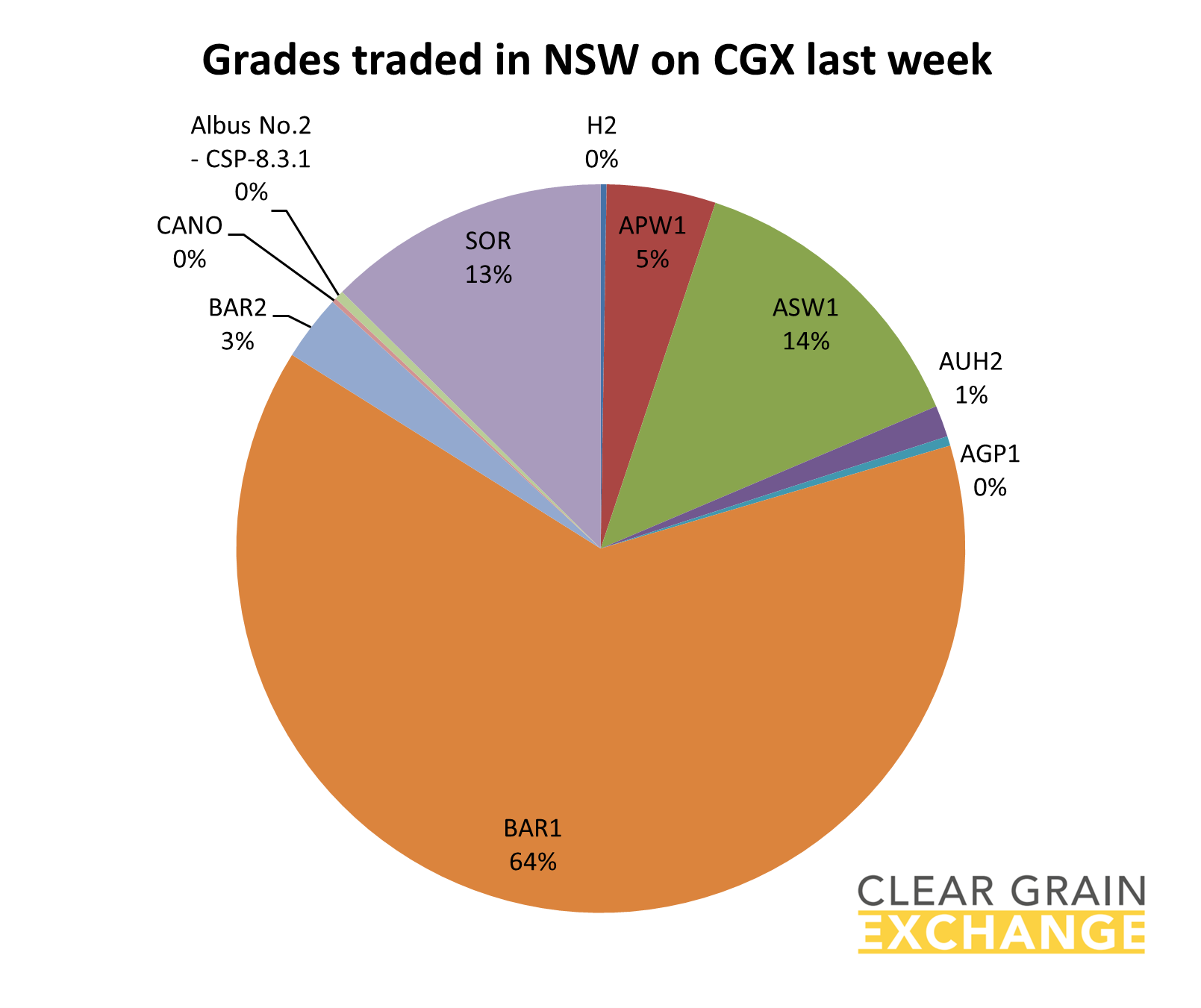

17 in NSW

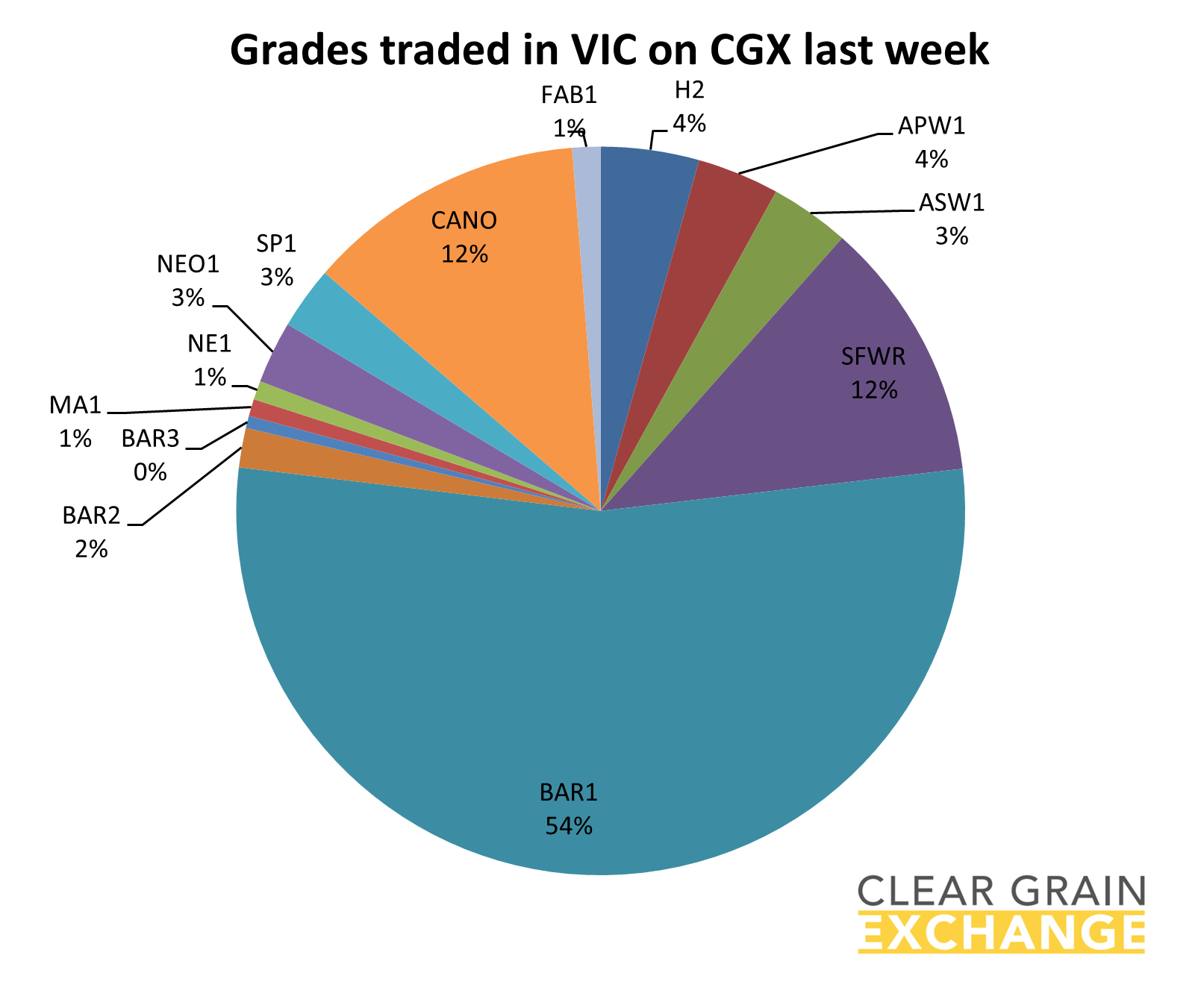

12 in VIC

13 in SA

18 in WA

222 sellers sold grain through CGX across 287 transactions - more were offering grain for sale

11 agent and/or advisory businesses sold grain on behalf of growers

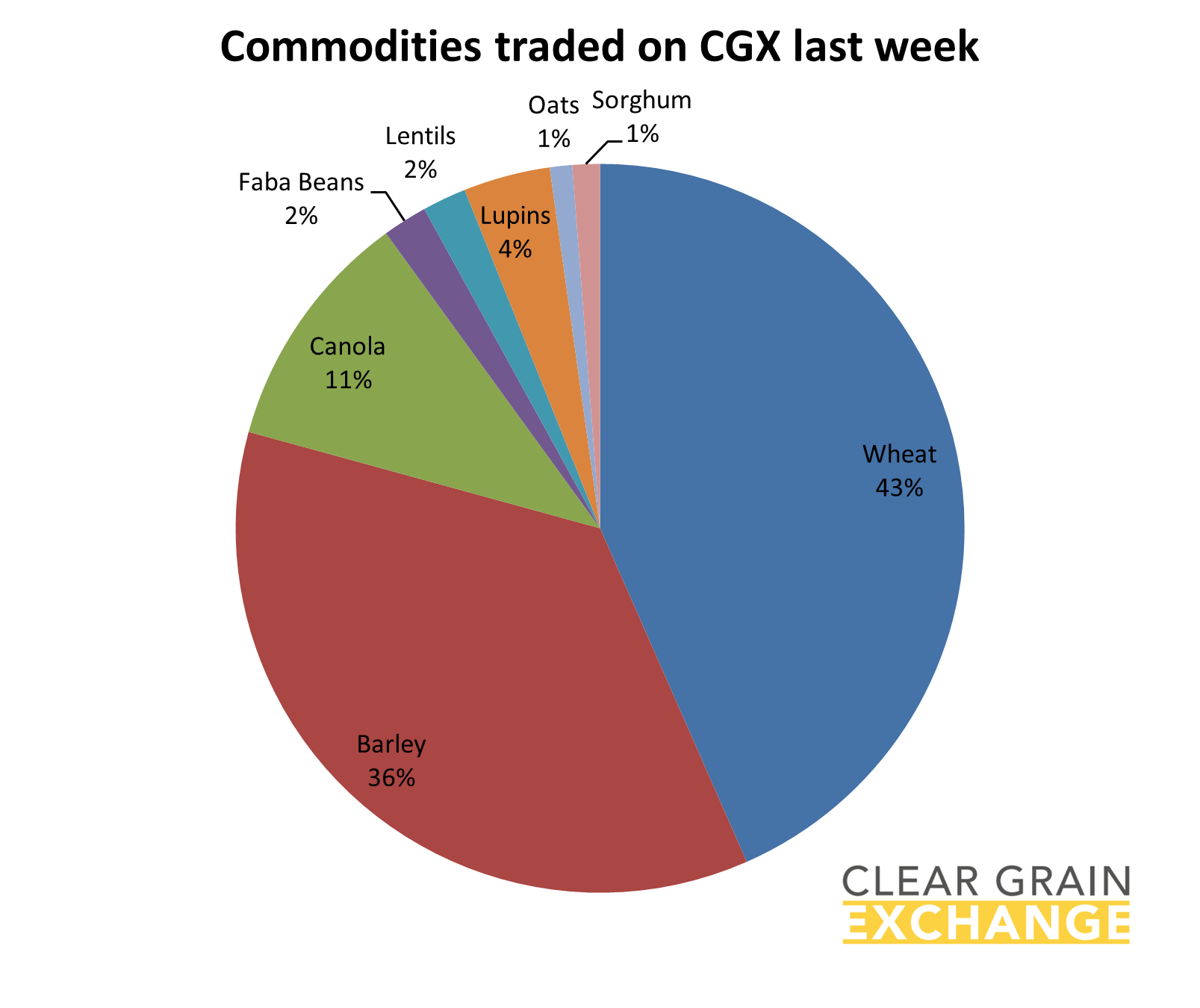

44 different grades traded

8 commodities - Wheat, barley, canola, faba beans, lentils, lupins, oats, sorghum

15 port zones traded across NSW, VIC, SA and WA

Pockets of demand create opportunity

Pockets of demand continued to emerge through last week providing some opportunity for growers to get sales away at prices they had set.

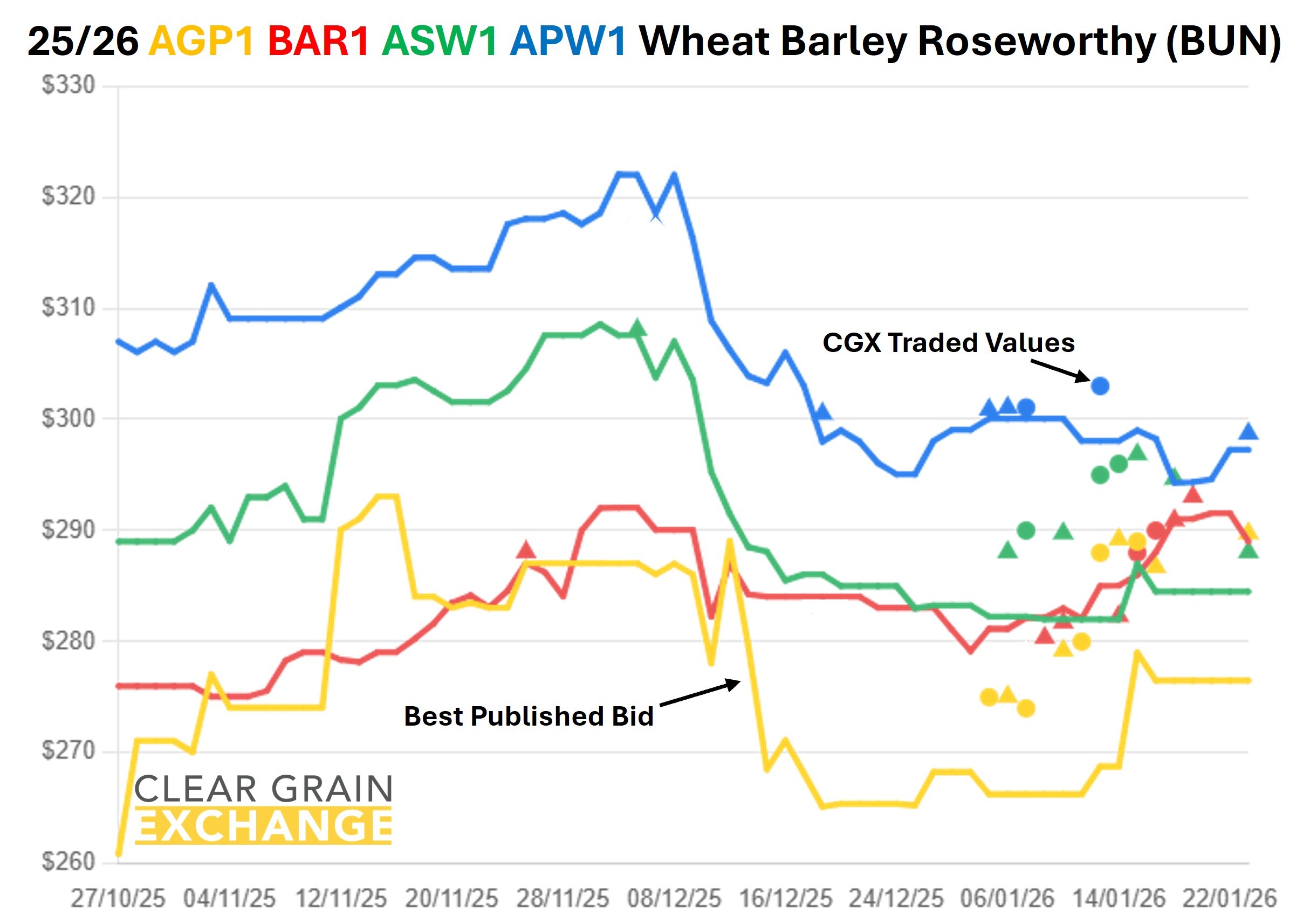

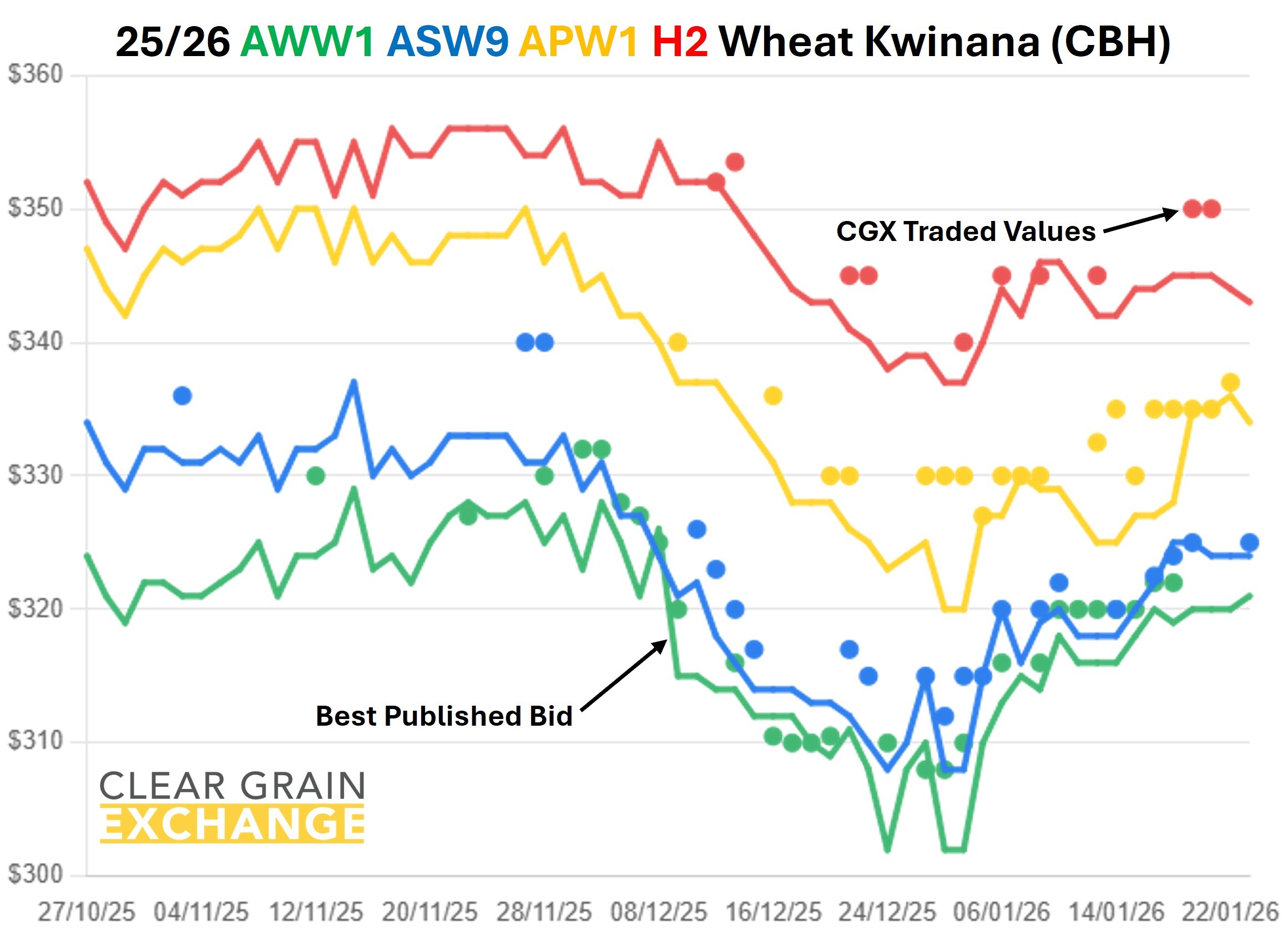

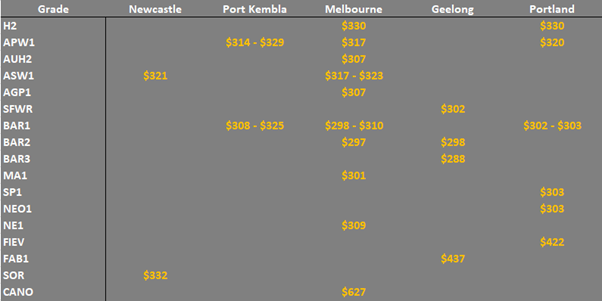

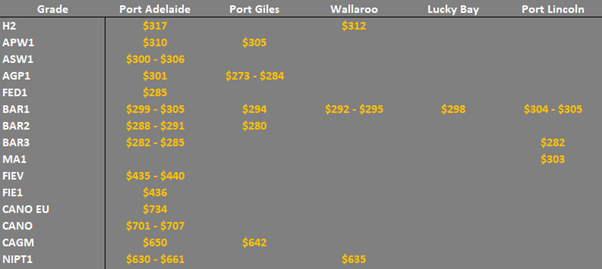

ASW1 wheat was trading $323/t track Melbourne, $321/t Newcastle, $306/t Pt Adelaide and the equivalent AWW1 grade in WA was trading $322/t FIS Kwinana.

APW1 quality wheat was trading $5-15/t above ASW1 depending on the port zone. Higher protein H2 was trading another $7-15/t above APW1 and H1 was trading $390/t FIS in the west.

Feed wheat grades were trading on par with ASW1 type wheat in some parts of the country and under in other areas. Compared with barley prices right now, wheat looks undervalued.

Barley continues to find demand into export markets as does canola, sorghum, pulses and some of the wheat grades. Though much of the wheat is struggling to price for export while Argentine wheat continues to flow into global markets.

Supply chain operators would like to see more wheat flowing out for export after some large crops which makes for an interesting dynamic while growers are generally holding out for better prices on many wheat grades.

Feed barley was trading $325/t track Pt Kembla, $310/t Melbourne, $305 Pt Adelaide and $333/t FIS in Kwinana. Malt's aren't gaining much if any premium with feed export markets driving prices here.

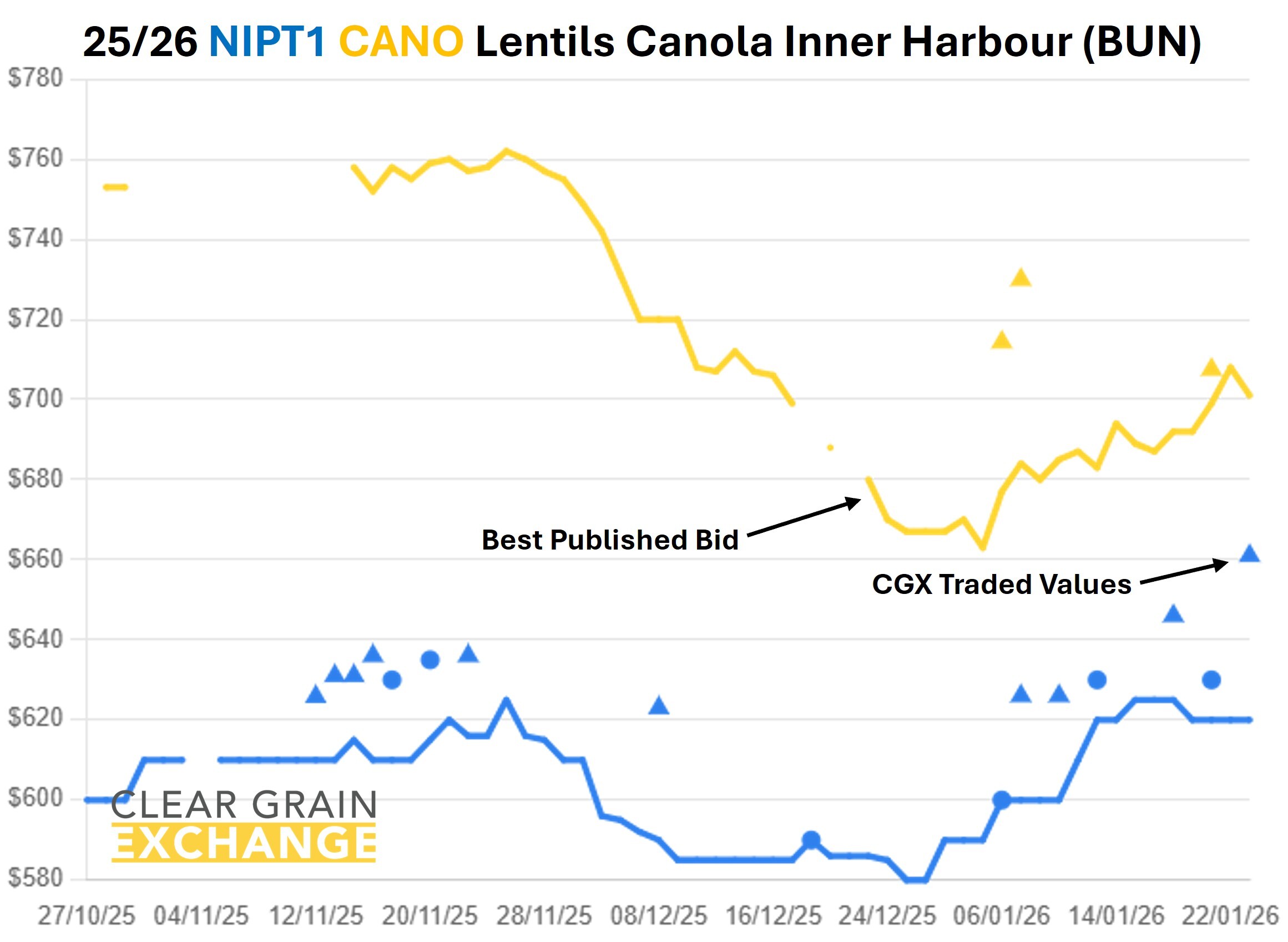

Canola was trading $734/t Pt Adelaide and $800/t Kwinana + oil bonification payments, while GM canola was trading $650/t Pt Adelaide and $700/t Kwinana + oil.

Pulses are attracting interest across the spectrum of crops with faba beans trading $440/t Pt Adelaide and $437/t Geelong. Lentils were $661/t Pt Adelaide, and lupins $355/t Kwinana.

Old crop sorghum was trading $332/t Newcastle last week.

Growers are impacting the price of Australian grain by offering grain for sale and leading the direction of all bids.

42 buyers purchased grain through Clear Grain Exchange (grain stored in warehouse) and igrainX (grain stored on-farm) last week.

Additionally, 46 buyers were bidding for grain offered for sale and 115 buyers made 8,078 searches for grain offered for sale.

The lift in buyer interest is generally typical early in the New Year as export programs ramp up and domestic users respond to the shape of the crop's quality to secure what they need. If you have a sell price, it's time to put it out there.

There are plenty of buyers for Australian grain, demand often lifts early in the New Year. Make it easier for all buyers to try and buy your grain.

Growers are creating the price opportunities for their grain by offering grain for sale to all buyers at the price they will sell for - it attracts buyer demand and bids.

Set your price, impact the market, and know that if the market reaches your price it will sell, while enjoying some family time through January.

Your grain can't sell at the price you want if you don't have it out there offered for sale, particularly if you're not watching markets while on holiday.

There’s no downside in offering your grain for sale, only upside – why wouldn’t you offer all of your grain for sale at prices you're happy with? Be proactive, take control, and offer.

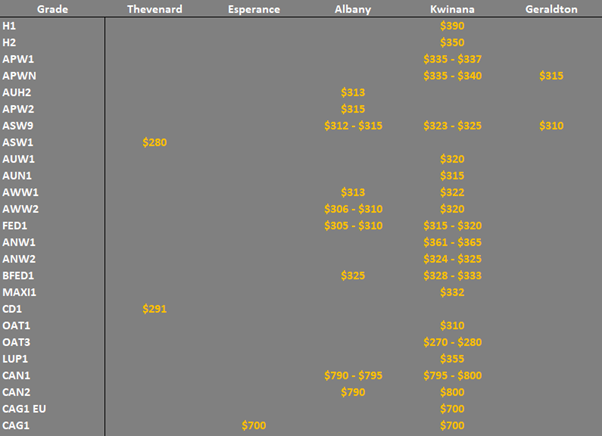

The prices traded through the exchange at a port track (eastern states) or FIS (in WA) level are provided below, but if you're reading this email you will have your own CGX account so login and use it to see what's trading, what's offered, and what's being bid at sites to help you determine the value of grain in your area.

Please call the CGX team anytime for assistance on 1800 000 410.

The tables below provide a summary of traded prices on CGX last week

Note: GTA location differentials are used to convert prices to a port equivalent price, actual freight rates can differ particularly in the eastern states. You can offer any grade for sale to create demand.

The charts below provide a summary of grain traded last week

CGX now own and operate the igrainx market for grain stored on-farm

If you have any queries, we're always here to help!

Please give us a call or email if you have any questions.

Call 1800 000 410 or Email support@cgx.com.au