Grain stored on-farm can now be sold on CGX

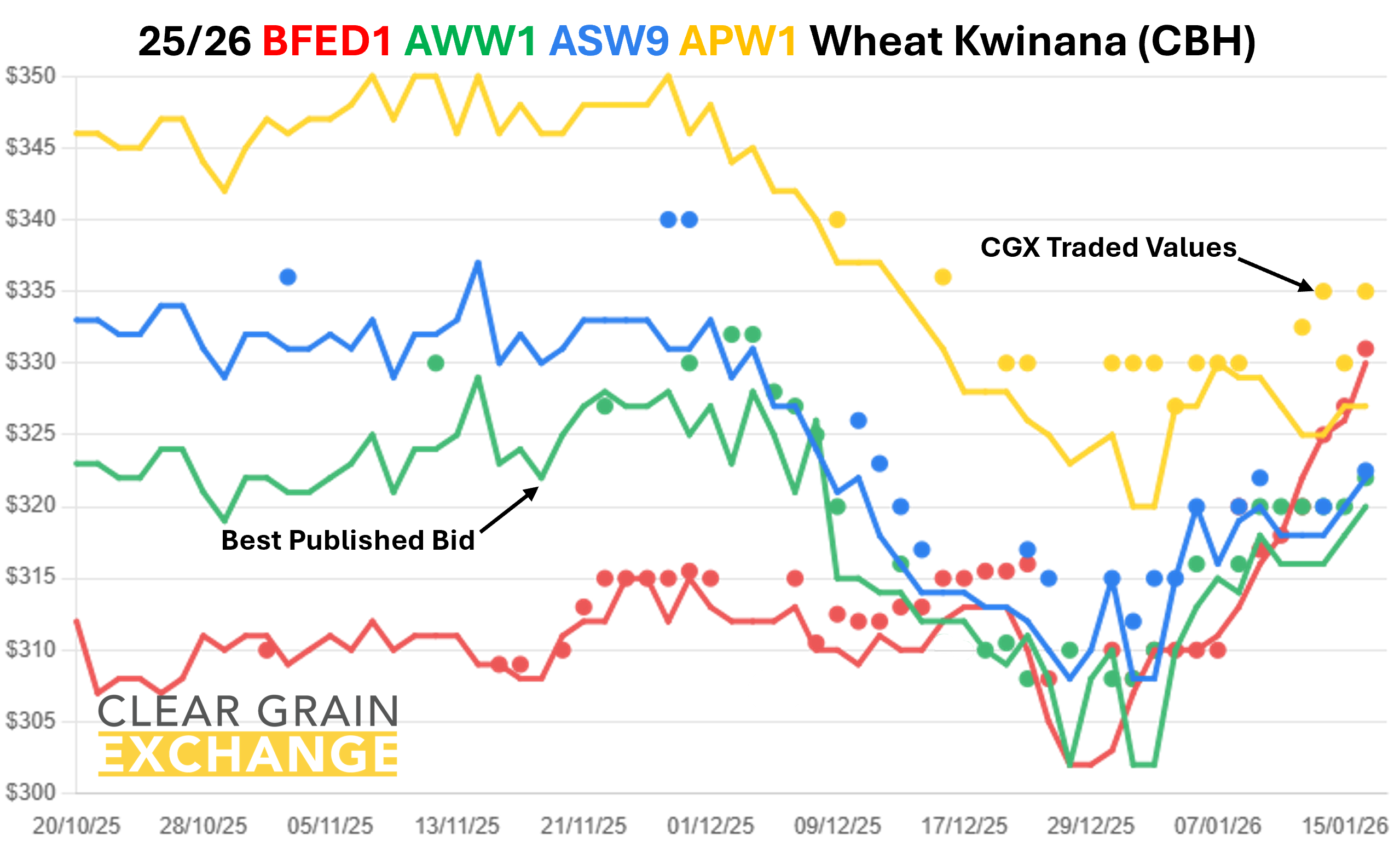

Prices improve across many grades - Barley, canola, lentils and chickpeas saw improvements in prices with some wheat also reaching grower targets.

Richard Koch, experienced grain analyst from Elders, shares his thoughts - Barley is strong versus wheat. Can wheat bounce?

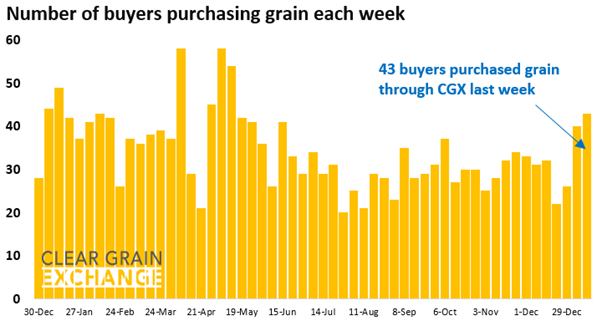

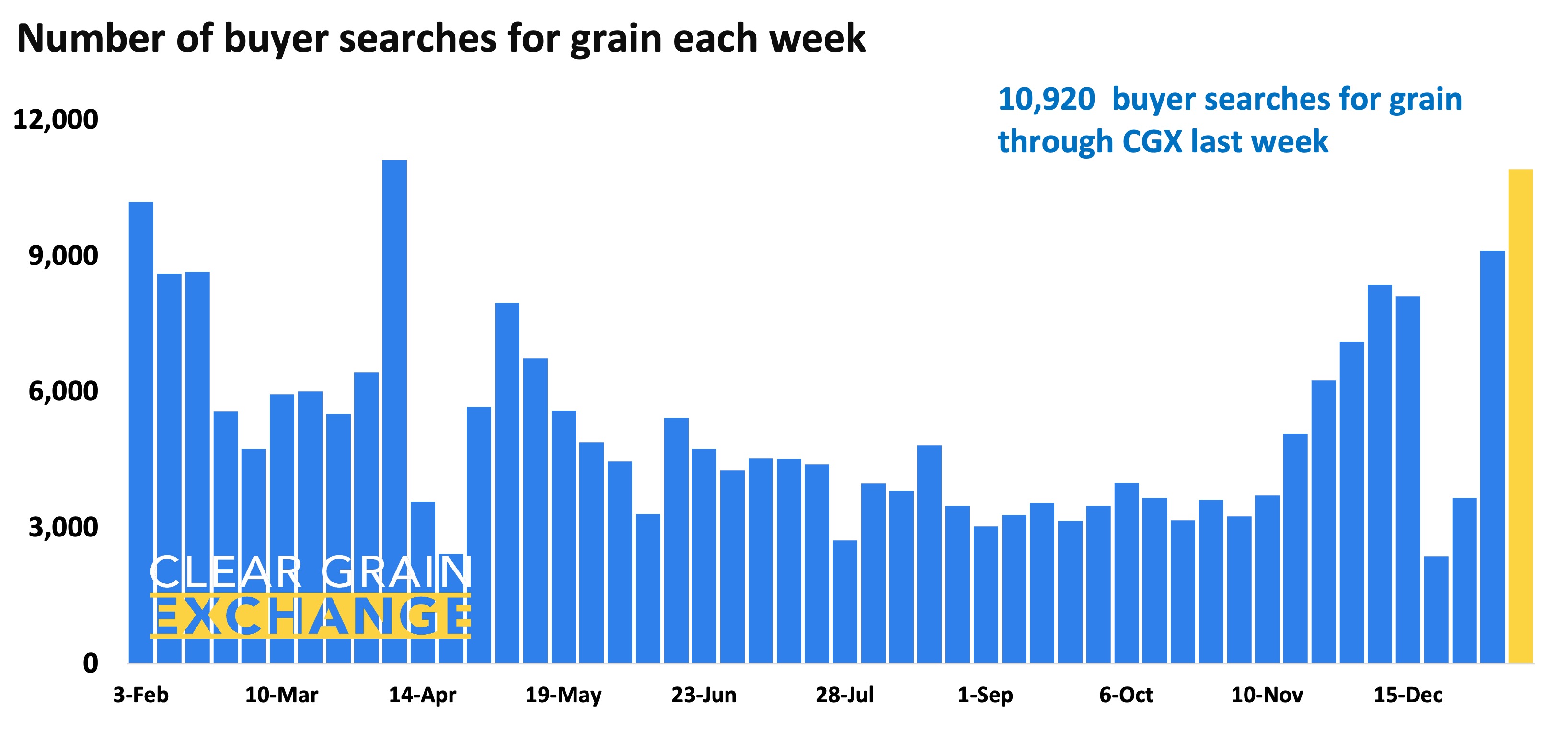

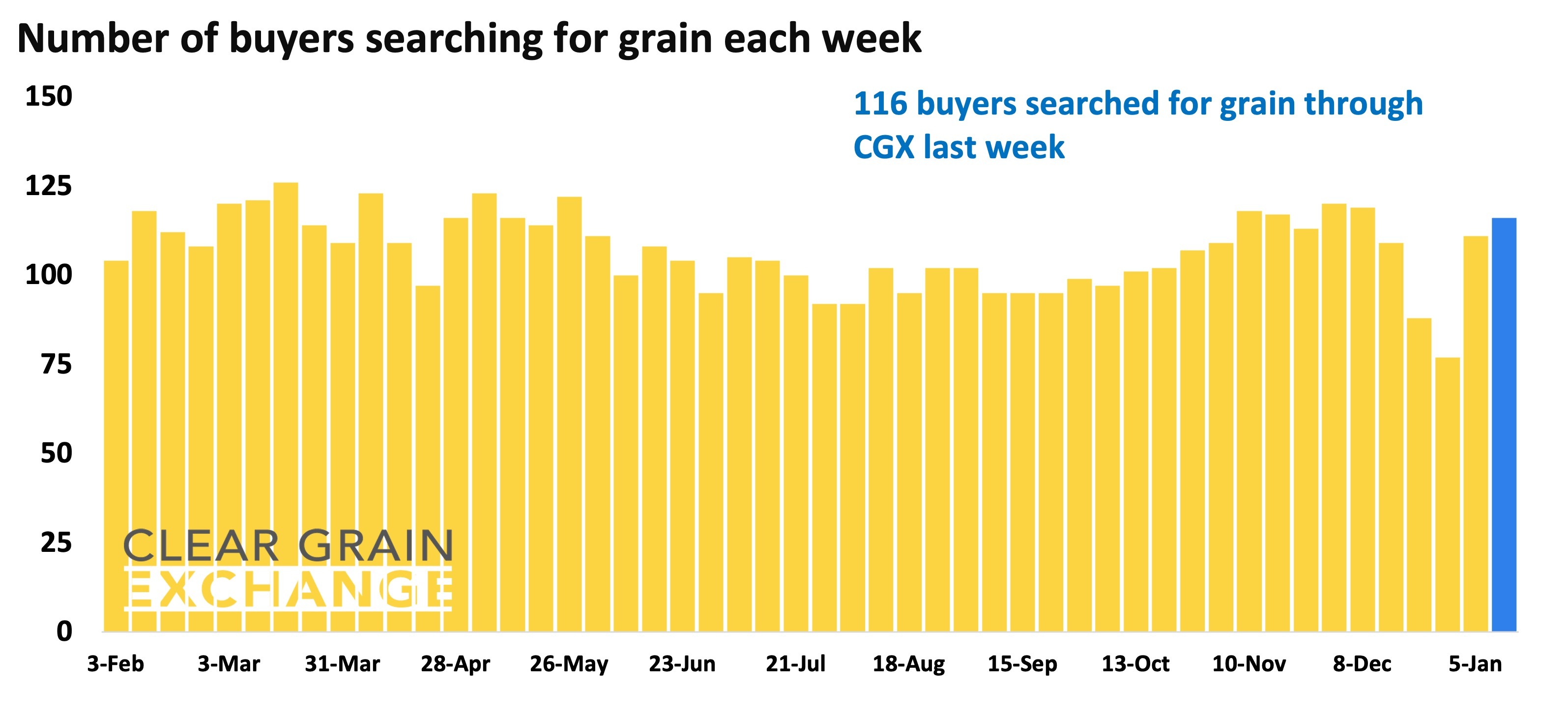

Number of buyers searching for grain continues to rise - 116 buyers made 10,920 searches for grain offered for sale. 53 buyers were bidding for grain.

When your grain is offered for sale on CGX all buyers can see it and try to purchase it.

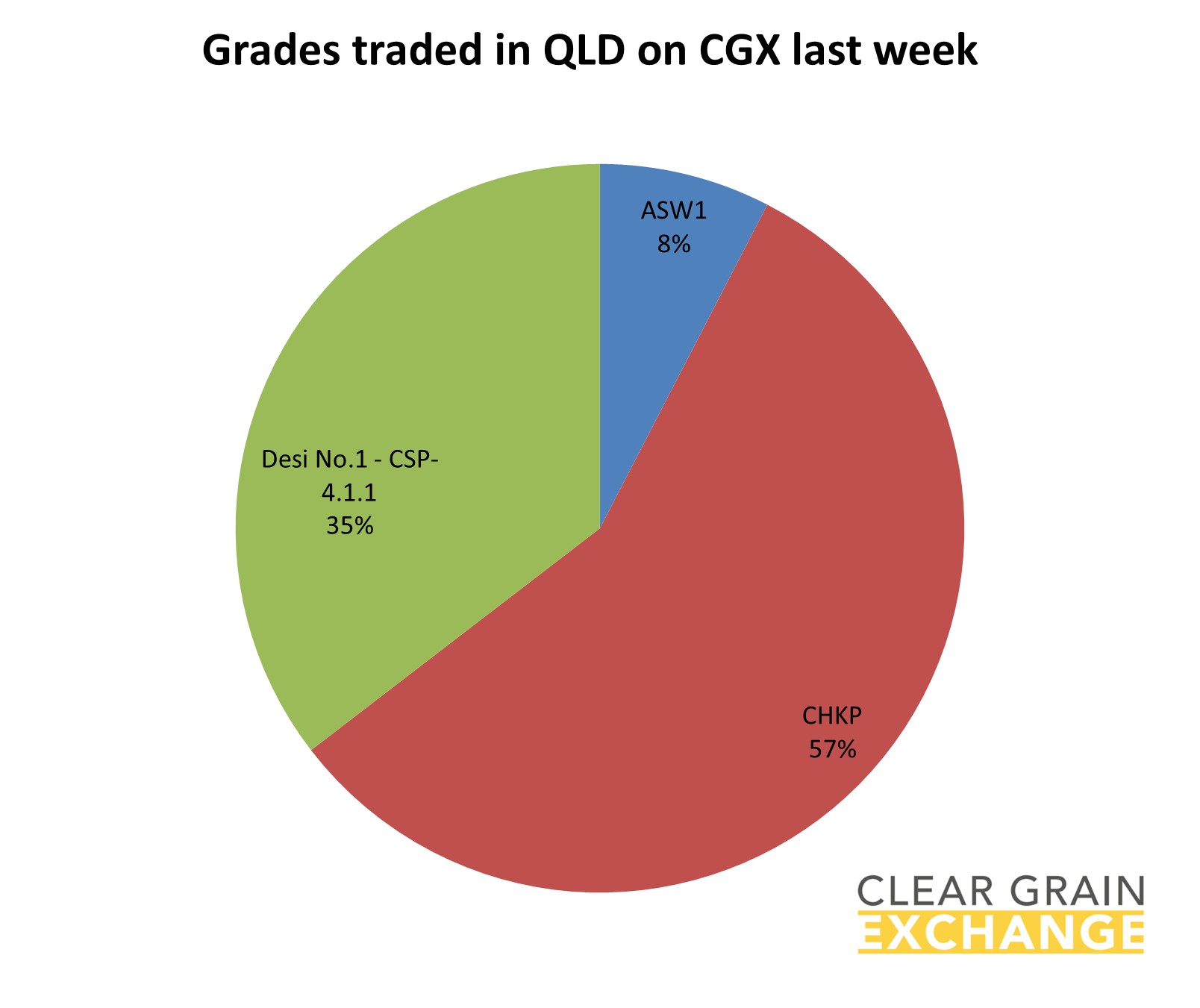

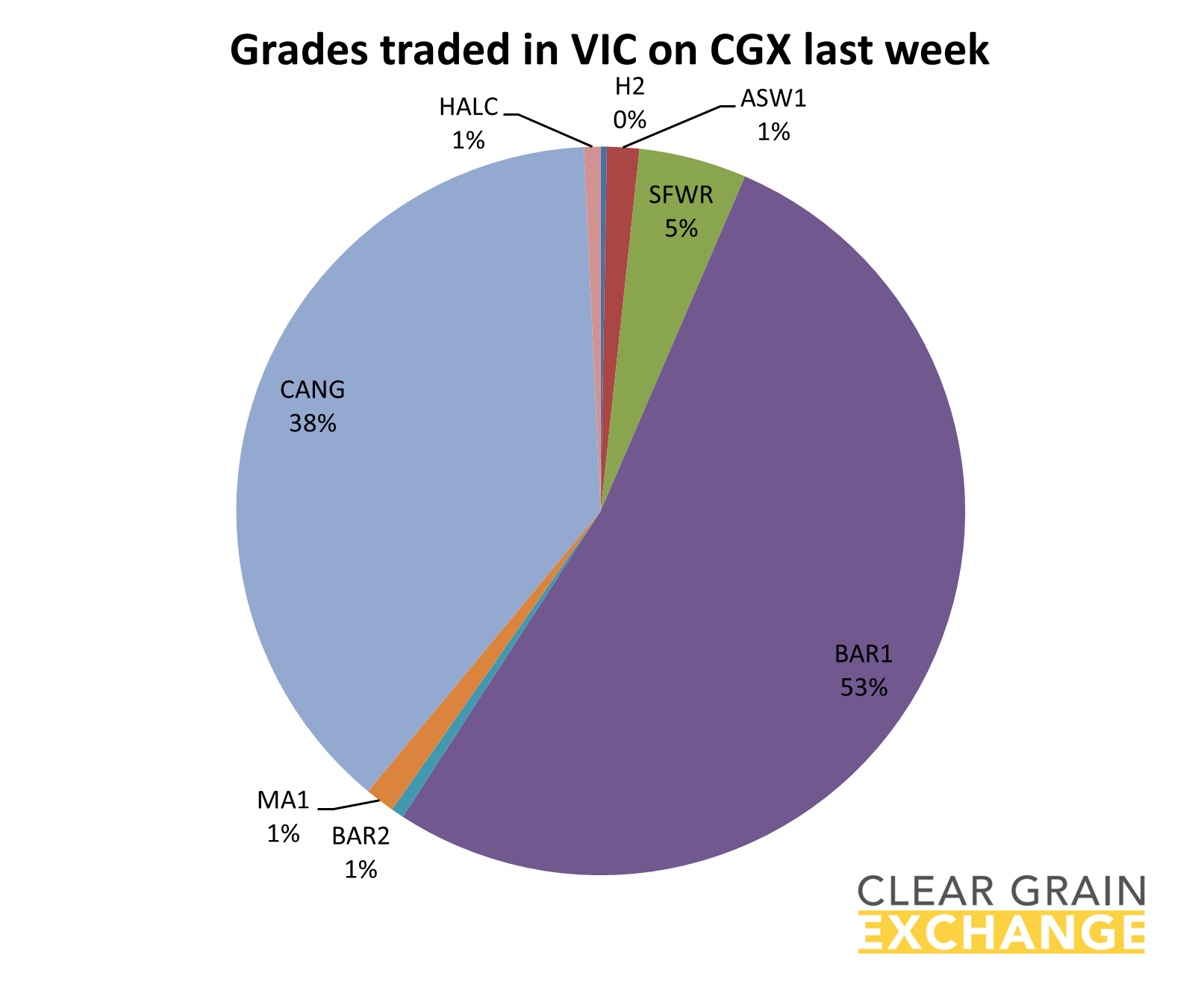

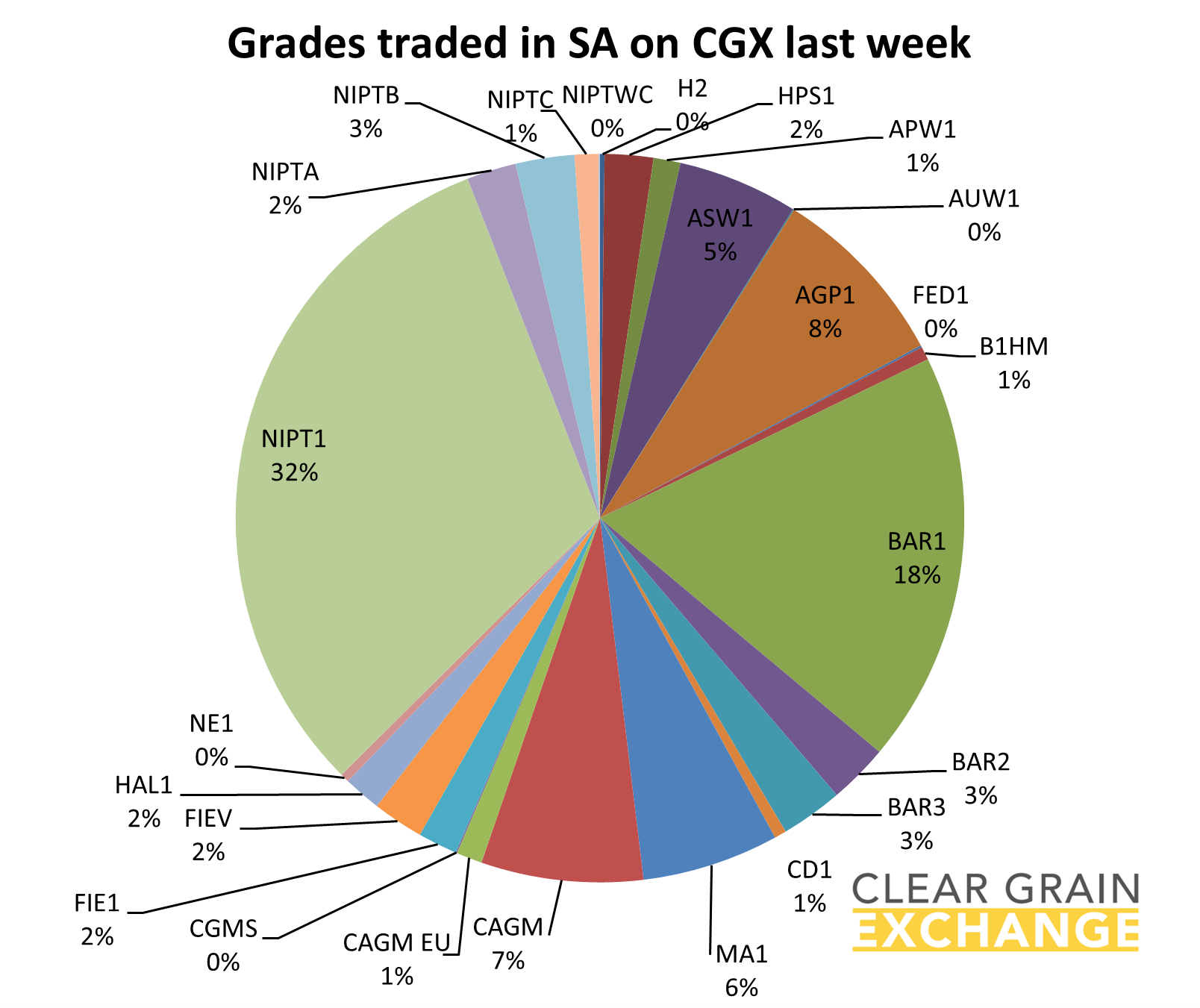

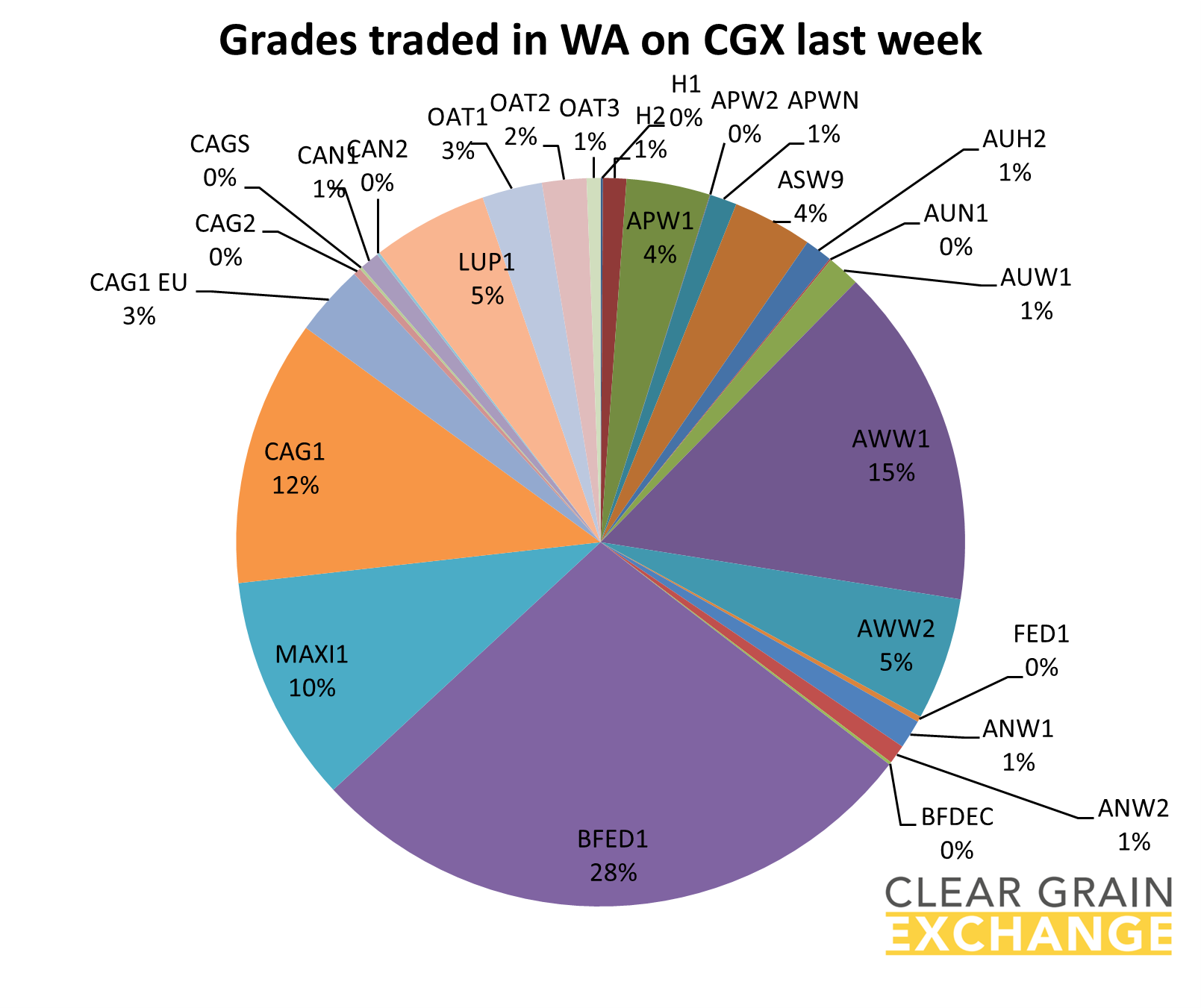

Market stats for last week

43 buyers purchased grain on CGX - more were searching for grain

4 in QLD

16 in NSW

11 in VIC

12 in SA

22 in WA

494 sellers sold grain through CGX across 793 transactions - more were offering grain for sale

17 agent and/or advisory businesses sold grain on behalf of growers

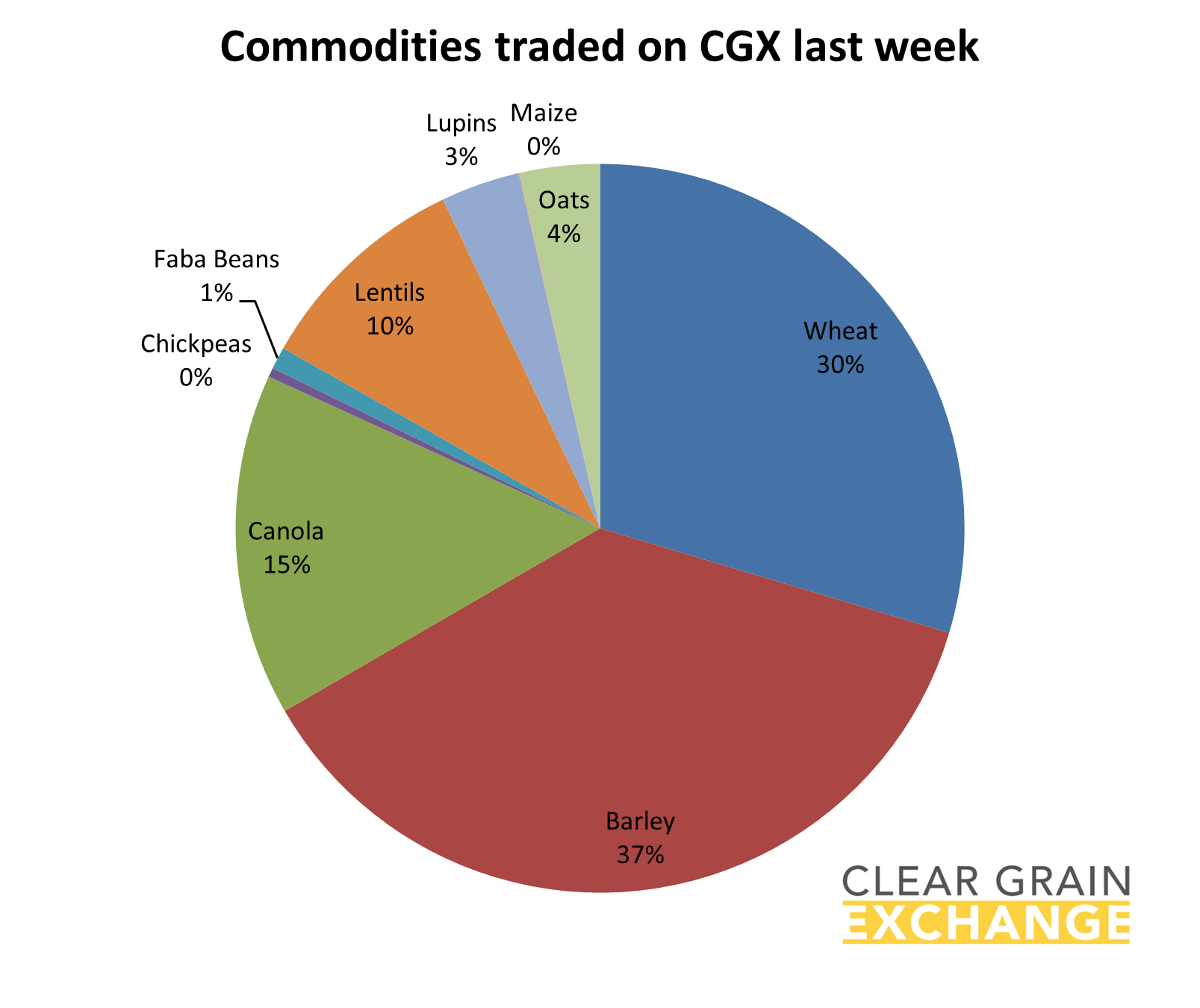

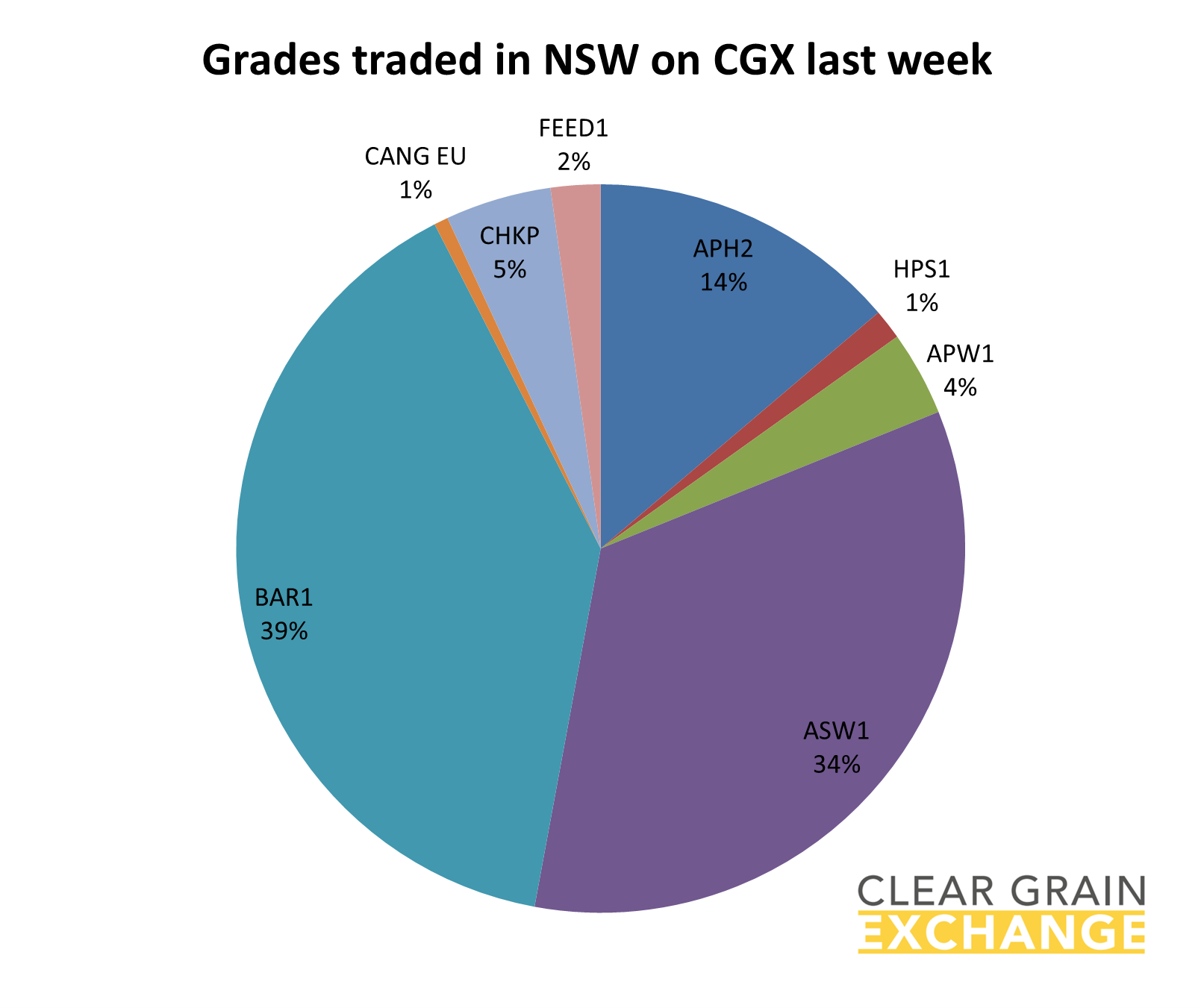

56 different grades traded

9 commodities - Wheat, barley, canola, chickpeas, faba beans, lentils, lupins, maize, oats

16 port zones traded across QLD, NSW, VIC, SA and WA

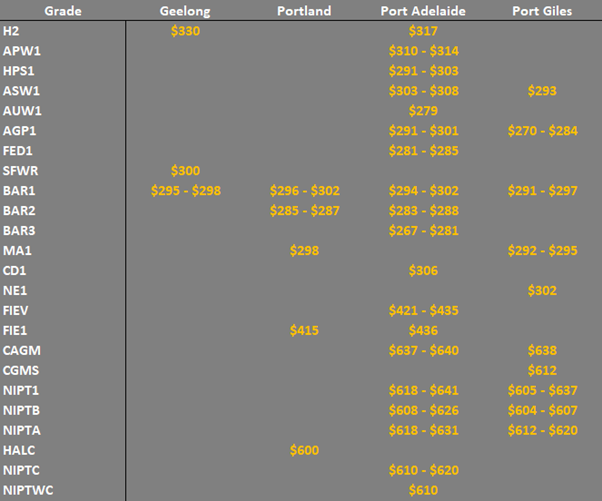

Prices improve across many grades

Grain prices improved across many grades last week as buyers bid up to match grower offer prices across most Australian port zones.

Feed barley rose $10-15/t in many locations across Australia with more buyers active in searching and bidding. Feed barley is now trading only $5/t below APW1 in the west.

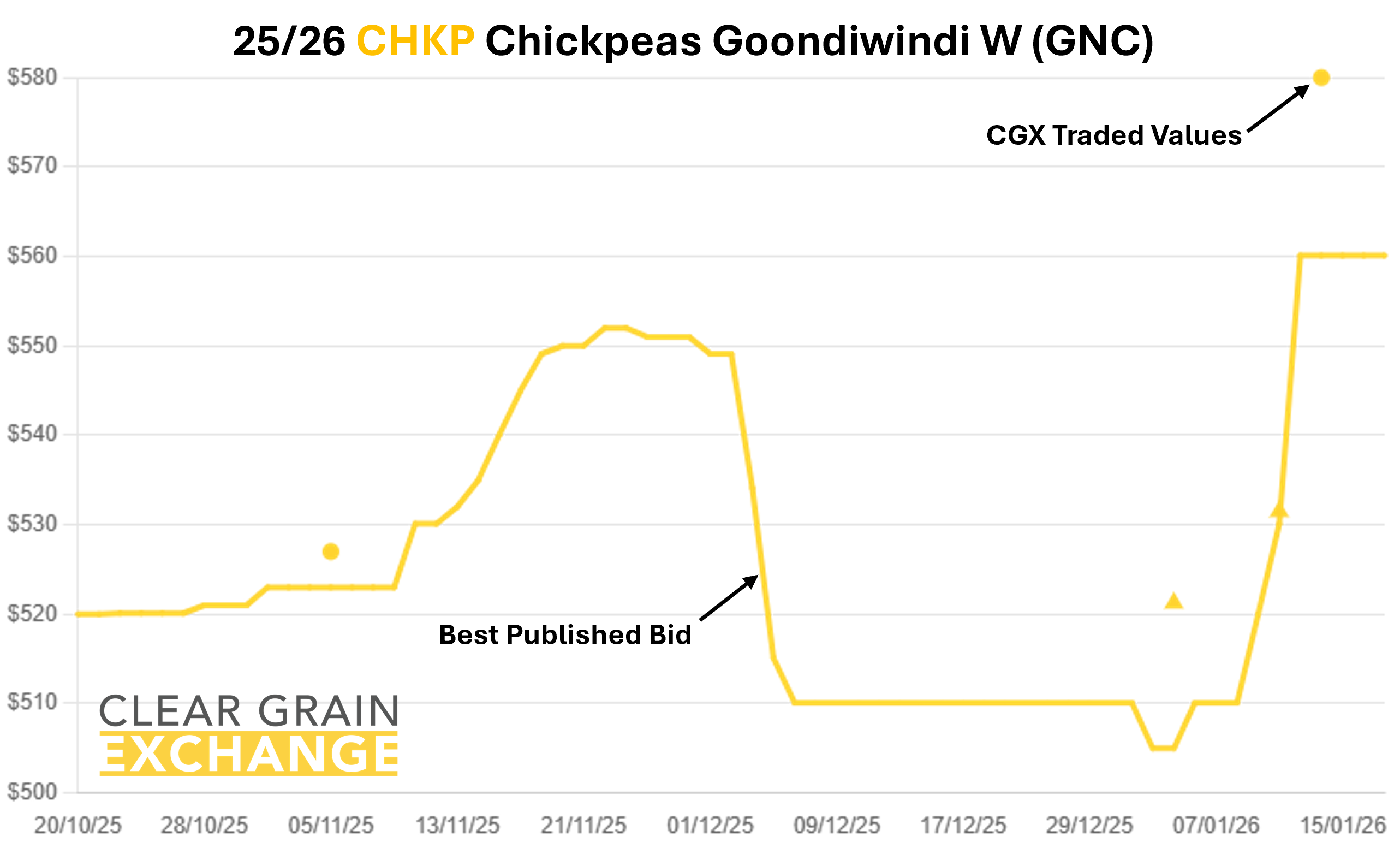

Lentil and chickpea prices have also pushed higher as the number of buyers increased in trying to secure tonnes and pushed bid prices up to match grower offers.

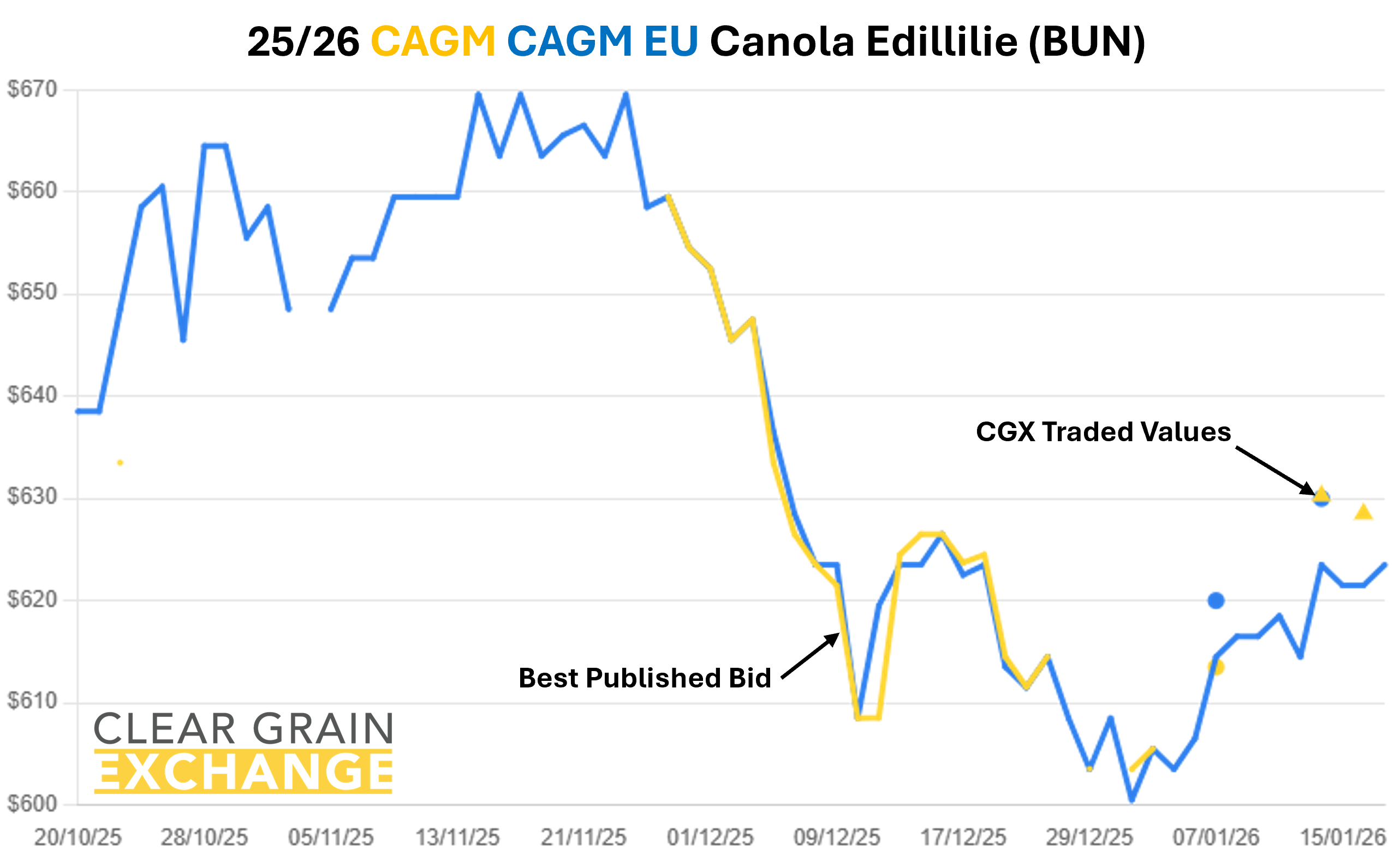

Canola prices have also improved, particularly GM canola which has improved $25/t or more over the past fortnight across a number of southern locations.

Wheat grades continued to trade across all states though made up a smaller proportion than normal of traded volume last week at 30%. Growers generally continue to offer wheat at higher prices than buyers are bidding currently and have been form on these offer levels.

Regardless of where prices are being bid, growers and their agents can offer grain for sale at prices they're targeting to sell.

Don’t just offer grain for sale when you're a seller, offer grain for sale when you know prices you will sell for. More growers are doing this and impacting prices.

Some thoughts below on the current market from experienced Elders Business Intelligence Analyst Richard Koch. You can get more regular thoughts from Kochy by subscribing to his daily comments in the CGX Market Open Report sent each morning before the CGX market opens for trading.

I think Argentina exports are keeping wheat down and suspect the Chinese crop is worse than they are saying.

Black Sea barley is US$10/t above milling wheat and EU is mostly finished. Lift in barley values could also be traders with positions in Melbourne/Geelong/Adelaide covering with WA barley. Suspect that growers in the aforementioned port zones will be holding barley tight as a drought hedge until the season breaks.

The other thing that it suggests to me is that wheat could bounce once Argentine wheat clears. Russian wheat has to be dragged a long way from central regions and with fuel costs in Russia high its not cheap like southern Russian wheat.

Growers are impacting the price of Australian grain by offering grain for sale and leading the direction of all bids.

Grain demand in the north eastern grain region of NSW and QLD was robust with 16 different buyers managing to match prices growers were asking for to purchase various grades of wheat, barley, canola, chickpeas, and maize.

There is more appetite from buyers for grain in that region then what is currently trading, there is simply not enough grain offered for sale, what ever the sell price. Growers in that region can be proactive in impacting prices by setting their sell prices and offering it to all buyers.

The number of buyers trying to buy grain is lifting early in the New Year.

43 buyers purchased grain through Clear Grain Exchange (grain stored in warehouse) and igrainX (grain stored on-farm) last week.

Additionally, 53 buyers were bidding for grain offered for sale and 116 buyers made 10,920 searches for grain offered for sale.

The lift in buyer interest is generally typical early in the New Year as export programs ramp up and domestic users respond to the shape of the crop's quality to secure what they need.

There are plenty of buyers for Australian grain, demand often lifts early in the New Year after the festive period. Make it easier for all buyers to try and buy your grain.

Growers are creating the price opportunities for their grain by offering grain for sale to all buyers at the price they will sell for - it attracts buyer demand and bids.

Set your price, impact the market, and know that if the market reaches your price it will sell, while enjoying some family time through January.

Your grain can't sell at the price you want if you don't have it out there offered for sale, particularly if you're not watching markets while on holiday.

There’s no downside in offering your grain for sale, only upside – why wouldn’t you offer all of your grain for sale at prices you're happy with? Be proactive, take control, and offer.

The prices traded through the exchange at a port track (eastern states) or FIS (in WA) level are provided below, but if you're reading this email you will have your own CGX account so login and use it to see what's trading, what's offered, and what's being bid at sites to help you determine the value of grain in your area.

Please call the CGX team anytime for assistance on 1800 000 410.

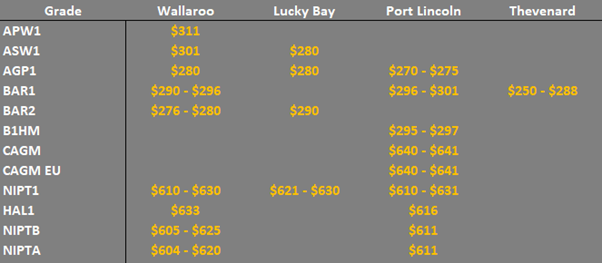

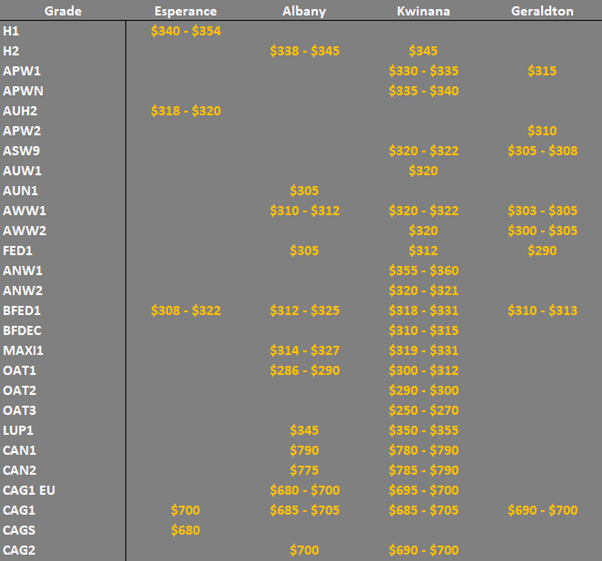

The tables below provide a summary of traded prices on CGX last week

Note: GTA location differentials are used to convert prices to a port equivalent price, actual freight rates can differ particularly in the eastern states. You can offer any grade for sale to create demand.

The charts below provide a summary of grain traded last week

CGX now own and operate the igrainx market for grain stored on-farm

If you have any queries, we're always here to help!

Please give us a call or email if you have any questions.

Call 1800 000 410 or Email support@cgx.com.au