Grain stored on-farm can now be sold on CGX

Harvest pressure on prices hits - Prices retreated in southern Australia as deliveries ramped up and many growers sold into cash bids in earnest.

Deliver and OFFER grain for sale - Rather than delivering and selling into cash bids, deliver and offer grain for sale to keep the market in balance.

CGX and igrainX enable growers to offer grain for sale - Growers delivering to warehouse can offer grain for sale on CGX. Growers with grain on-farm can offer grain for sale on igrainX and determine pickup/delivery timeframes.

When your grain is offered for sale on CGX all buyers can see it and try to purchase it.

Market stats for last week

31 buyers purchased grain on CGX - more were searching for grain

9 in QLD and NSW

3 in VIC

8 in SA

17 in WA

107 sellers sold grain through CGX across 140 transactions - more were offering grain for sale

8 agent and/or advisory businesses sold grain on behalf of growers

32 different grades traded

8 commodities - Wheat, barley, canola, chickpeas, lentils, lupins, oats, peas

13 port zones traded across QLD, NSW, VIC, SA and WA

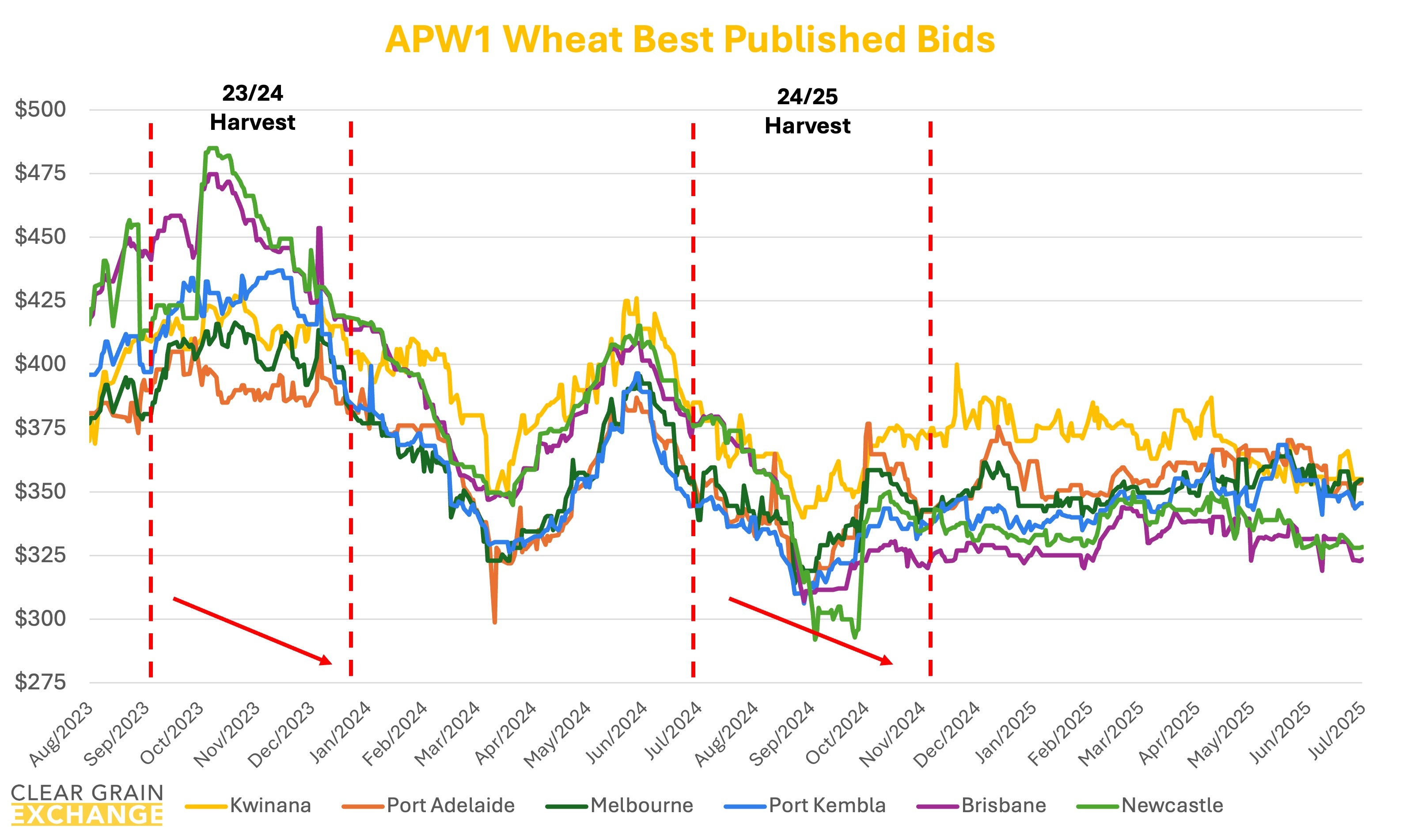

Harvest pressure on prices hits

Prices retreated last week through many areas of southern Australia as deliveries ramped up and many growers sold into cash bids in earnest.

The reality is grower selling behaviour impacts prices. If growers sell a lot of grain consistently into buyer bids advertised on cash boards, buyers will reduce their bids.

Price movement as a result of heavy grower selling is irrespective of what else is happening in the broader grain market. This means Australian grain prices can be reduced irrespective of movements in international futures, currency, FOB/CNF physical markets, or consumers wanting grain.

If growers sell large volumes into buyer bids, buyers will continue to reduce those bids until selling volumes reduce.

This is what was happening through last week. Harvest deliveries increased, particularly through south eastern Australia, and a large proportion of those deliveries were being sold as growers delivered them.

An alternative for all growers is to offer that grain for sale as it's being delivered at or around the buyer bid levels.

This enables the market to trade volume without reducing price. Buyers are trying to find price levels growers will sell for. Growers selling into cash bids suggests they may also sell at lower prices.

But if growers offer grain for sale at the same price as cash bids, it indicates to buyers that growers will sell at those prices, not below. It helps keep the market in balance rather than buyers reducing bids to see if selling continues.

Another dynamic that can happen when market prices fall is panic selling. At times growers can try and sell into falling bids and effectively undercut each other to get sales away, accentuating the fall in prices.

Most market fundamentals have not shifted significantly in a week. The major shift has been the volume of growers selling into lower and lower bids.

Bids have reduced, yet the selling has continued. If that behaviour continues, growers can expect many prices to continue downwards.

Growers are impacting the price of Australian grain by offering grain for sale and leading the direction of all bids.

There is plenty of demand for Australian grain. The number of buyer searches for grain offered for sale on Clear Grain Exchange and igrainX is rising as harvest continues.

We were seeing buyers logging in and searching grower offer prices on CGX and igrainX in the morning before setting their bids in the broader Australian grain market across cash bids and bid sheets. Last week however buyer cash bids were getting sold into, so they didn't need to take price guidance from grower offers!

Growers offering grain for sale are not just impacting prices of grain selling within the exchange, but all prices of grain being bid and trading in the broader Australian grain market. Just as growers selling into cash bids are also impacting all price levels for grain.

Offering grain for sale is not about selling for better prices than best published bids, it's about impacting all bids from all buyers, including those published bids advertised on cash boards.

Rather than delivering and selling by hitting cash bids, deliver and offer grain for sale at your price and help set the market. Be proactive, take control, and offer.

There are plenty of buyers for Australian grain, make it easier for them to try and buy your grain.

If you’re harvesting or finished harvest, now’s the time to offer grain for sale for all buyers to see on an independent exchange without bias to one buyer.

Last week 32 grades of wheat, barley, canola, chickpeas, lentils, lupins, oats and peas traded with 31 buyers purchasing grain through Clear Grain Exchange (grain stored in warehouse) and igrainX (grain stored on-farm).

But the impact of growers offering through the exchange is much larger than that! 41 buyers were bidding for grain offered for sale and 119 buyers made 8,367 searches for grain offered for sale.

More and more growers are logging in to cleargrain.com.au, or calling in, to offer grain for sale at the prices they're targeting. Growers using marketing agents are encouraging them to offer their grain for sale on the exchange.

Growers offering grain for sale through the independent exchange are impacting all buyer bids. There’s no downside in offering your grain for sale, only upside – why wouldn’t you offer all of your grain for sale at prices you're happy with?

Growers can help avoid downward price pressure at harvest by offering grain for sale - there is demand for Australian grain.

The prices traded through the exchange at a port track (eastern states) or FIS (in WA) level are provided below, but if you're reading this email you will have your own CGX account so login and use it to see what's trading, what's offered, and what's being bid at sites to help you determine the value of grain in your area.

Please call the CGX team at anytime for assistance on 1800 000 410.

The tables below provide a summary of traded prices on CGX last week

Note: GTA location differentials are used to convert prices to a port equivalent price, actual freight rates can differ particularly in the eastern states. You can offer any grade for sale to create demand.

The charts below provide a summary of grain traded last week

CGX now own and operate the igrainx market for grain stored on-farm

If you have any queries, we're always here to help!

Please give us a call or email if you have any questions.

Call 1800 000 410 or Email support@cgx.com.au