Grain stored on-farm can now be sold on CGX

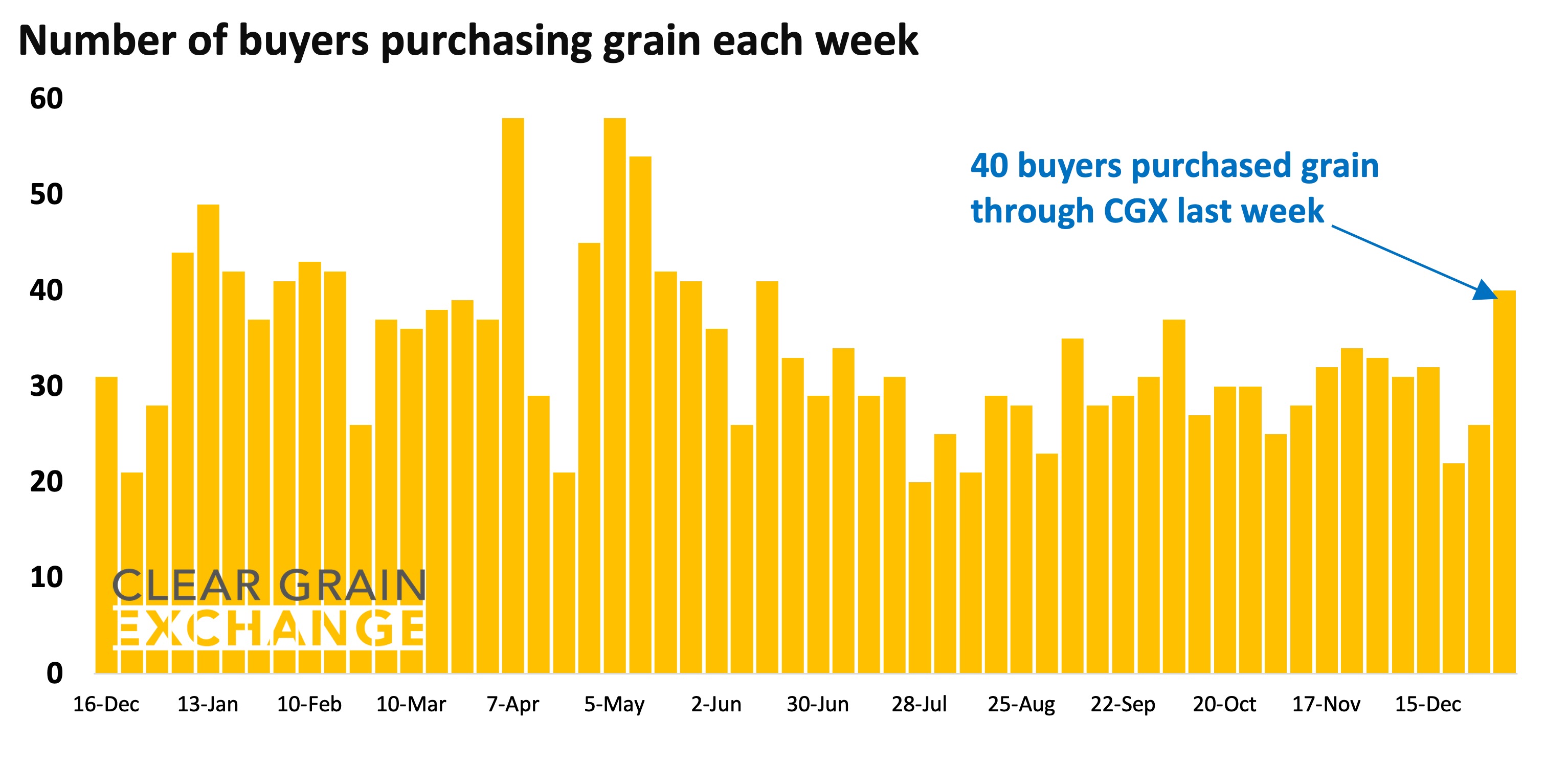

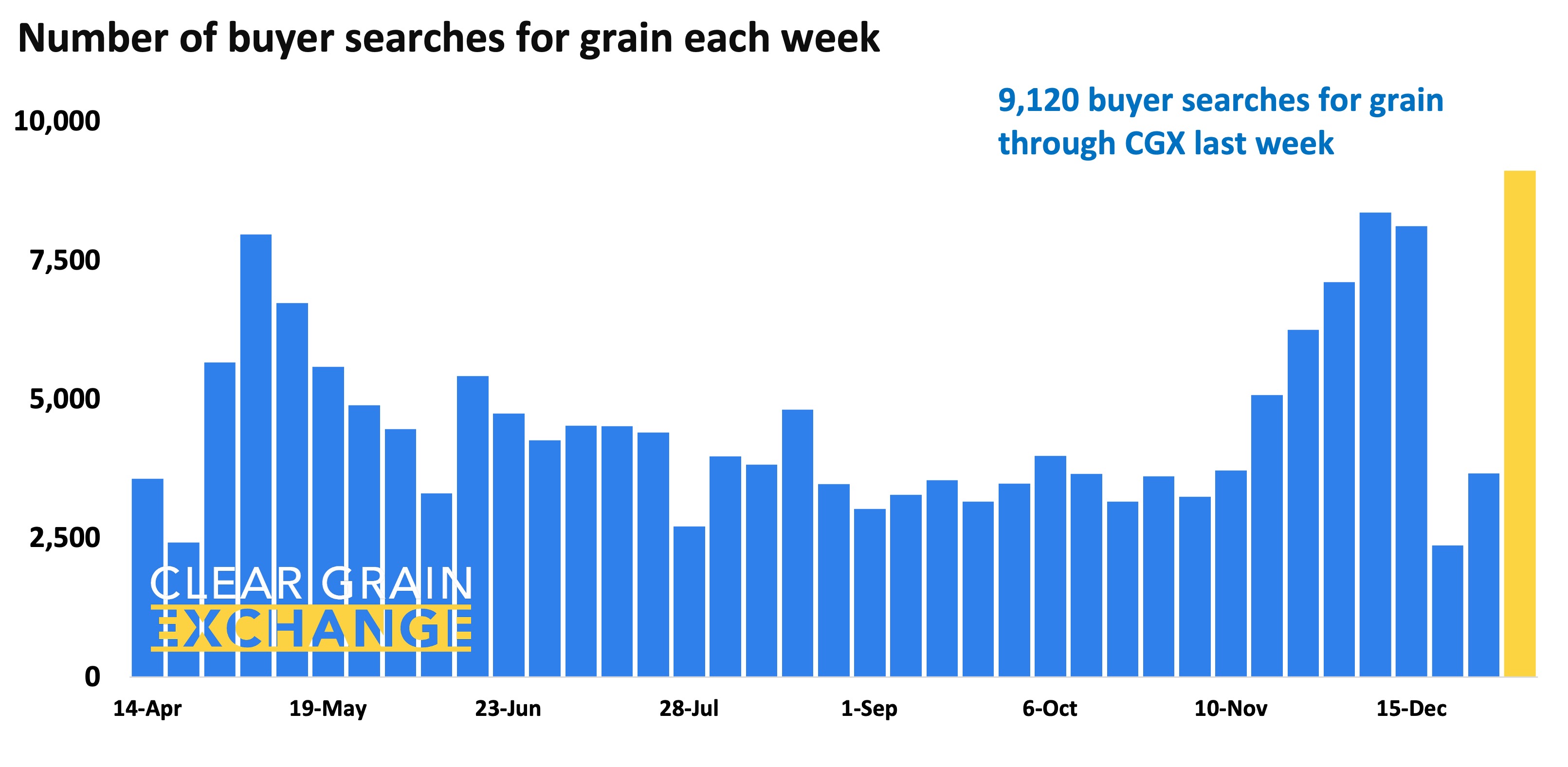

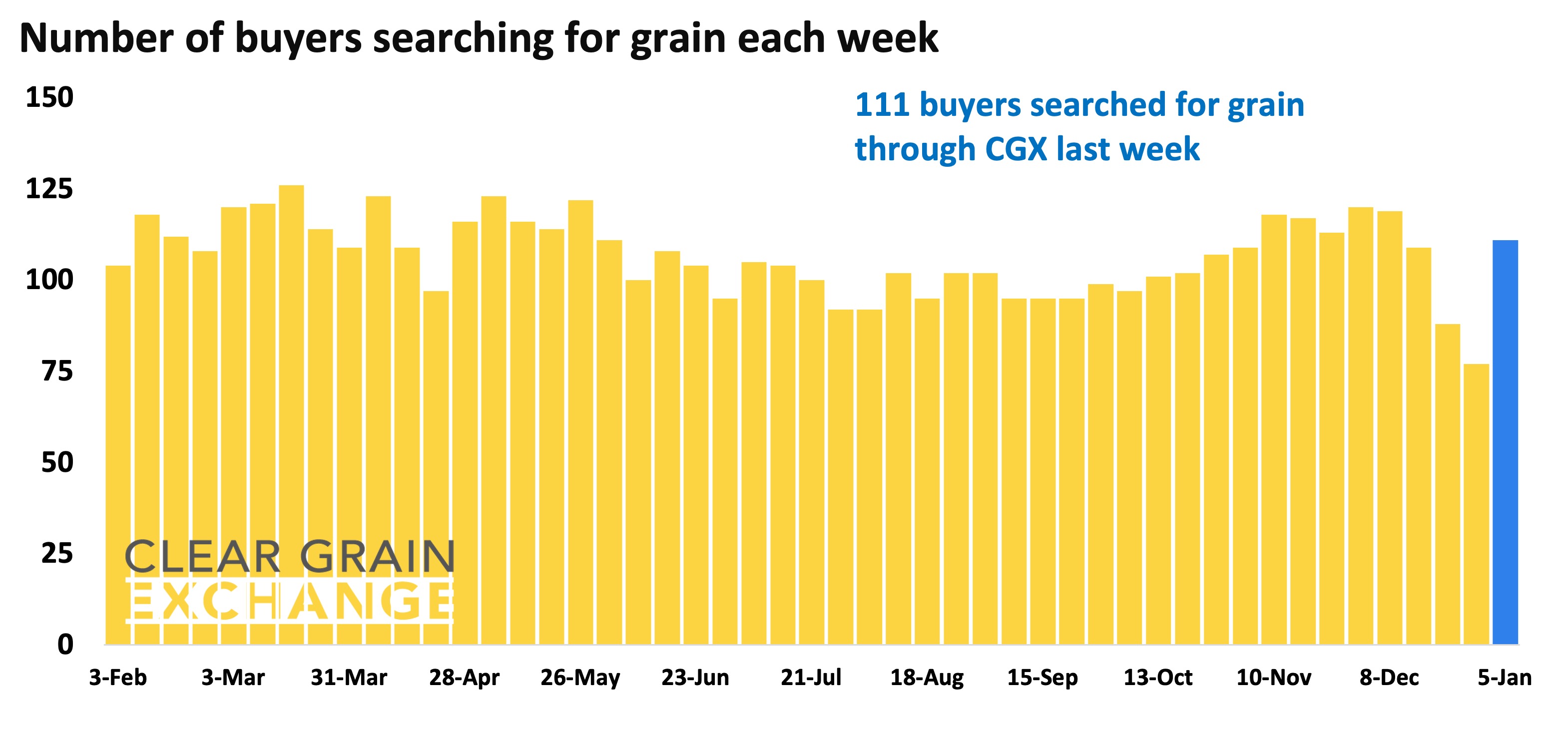

Buyer demand for grain lifts early in the New Year - The number of buyers and the frequency of them trying to buy grain is lifting early in the New Year.

Offer grain for sale at prices you will sell for - Regardless of where prices are being bid, growers can offer grain for sale at prices they want to sell.

CGX and igrainX enable growers to offer grain for sale - Growers delivering to warehouse can offer grain for sale on CGX. Growers with grain on-farm can offer grain for sale on igrainX and determine pickup/delivery timeframes.

When your grain is offered for sale on CGX all buyers can see it and try to purchase it.

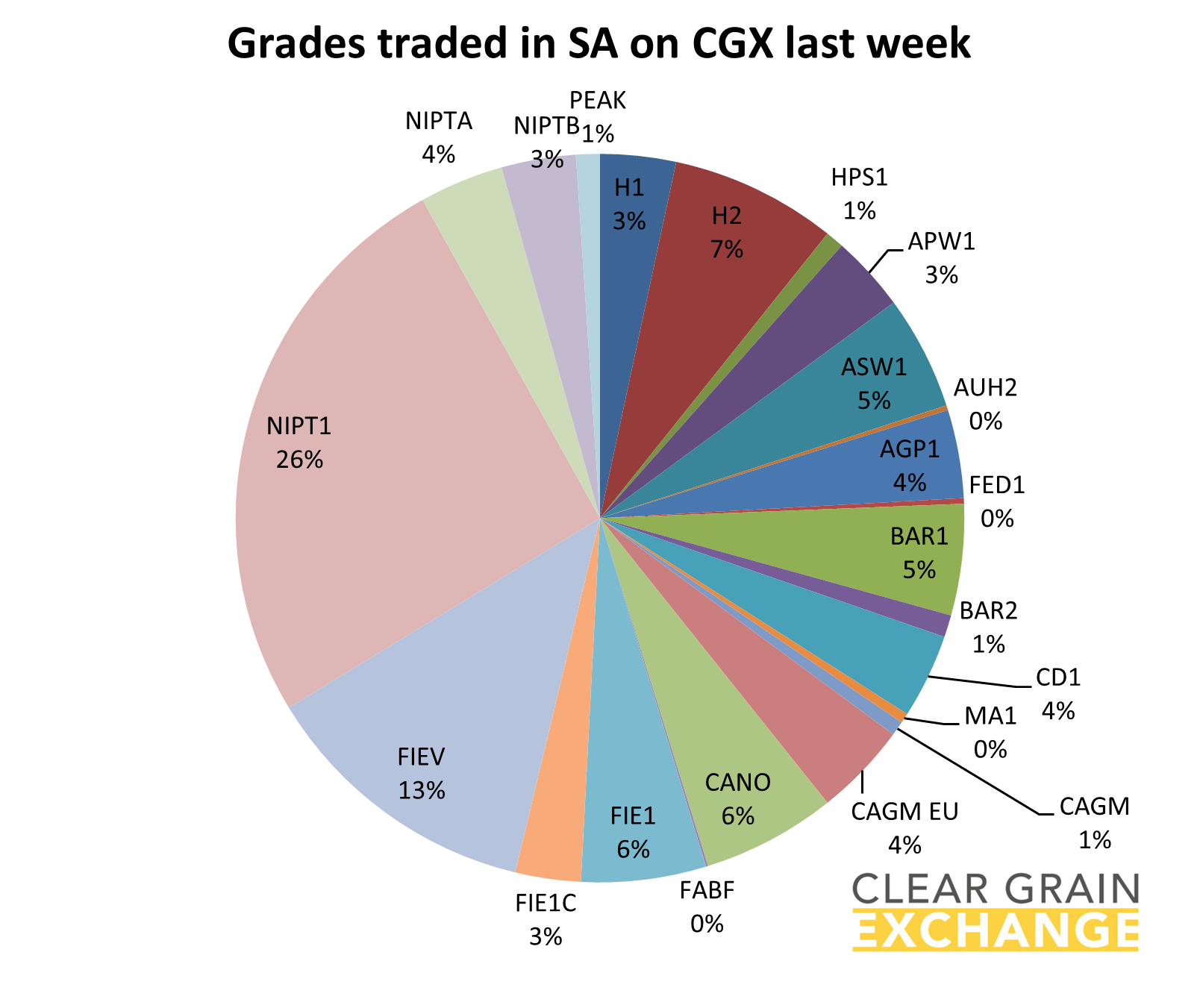

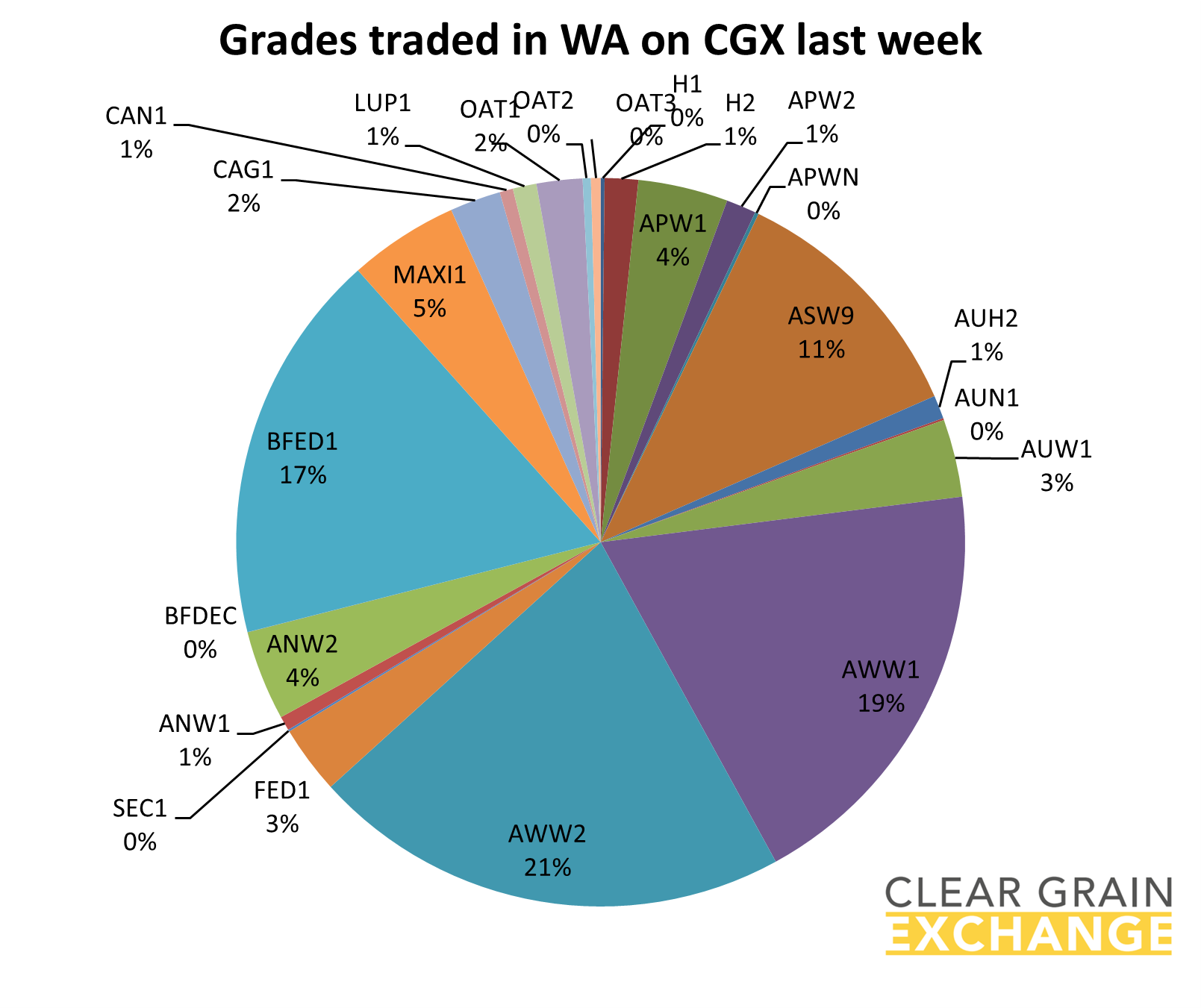

Market stats for last week

40 buyers purchased grain on CGX - more were searching for grain

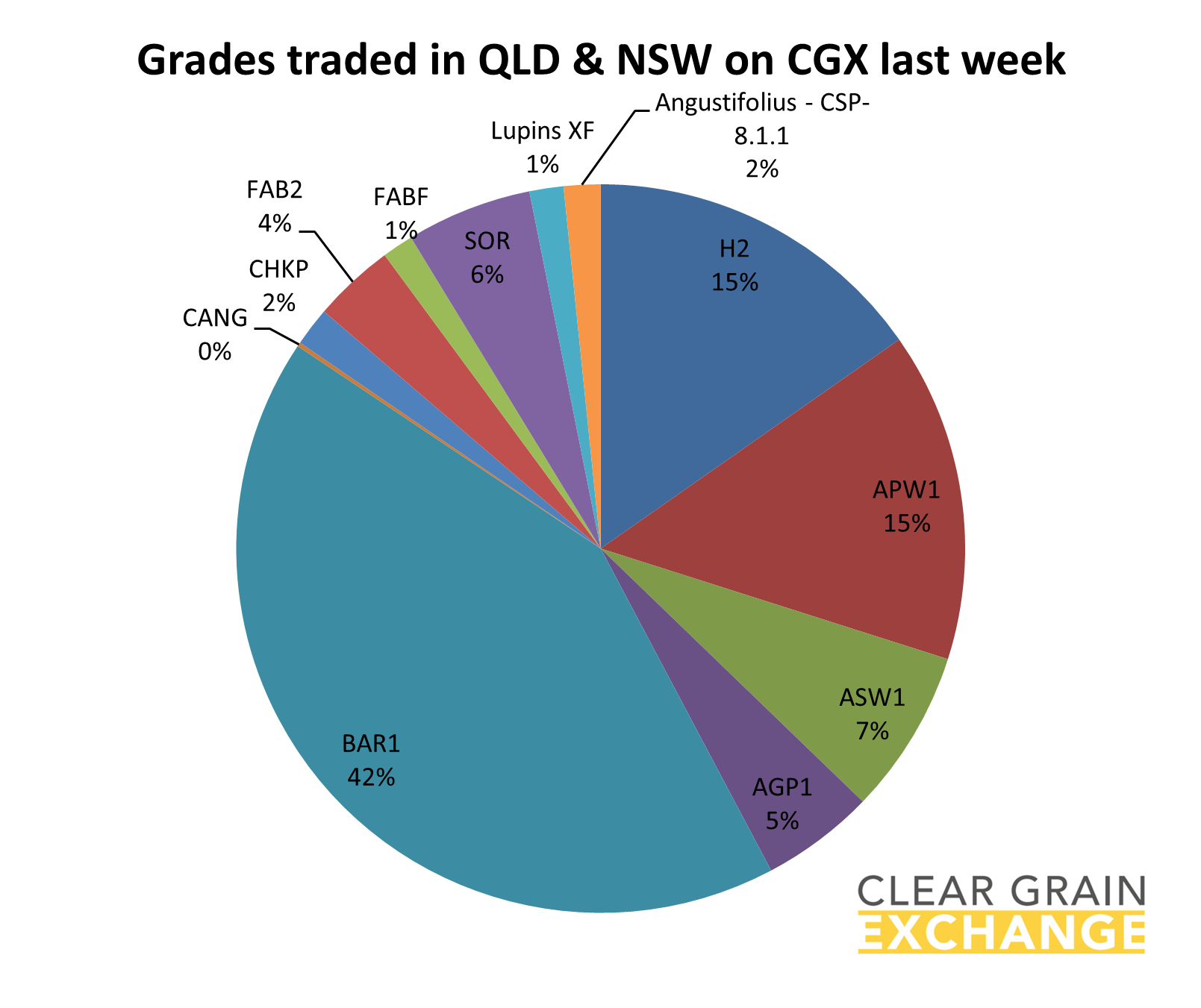

18 in QLD and NSW

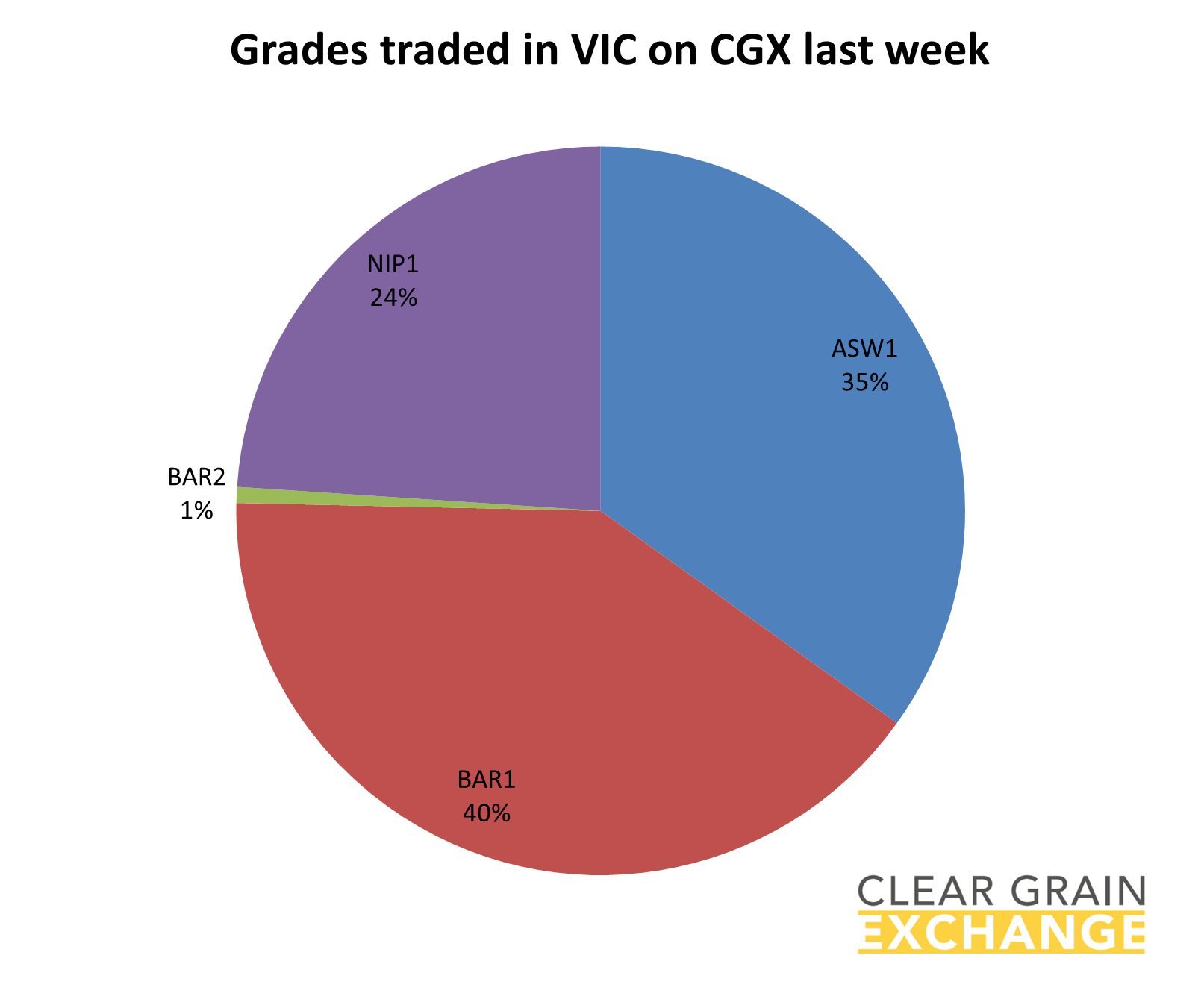

10 in VIC

12 in SA

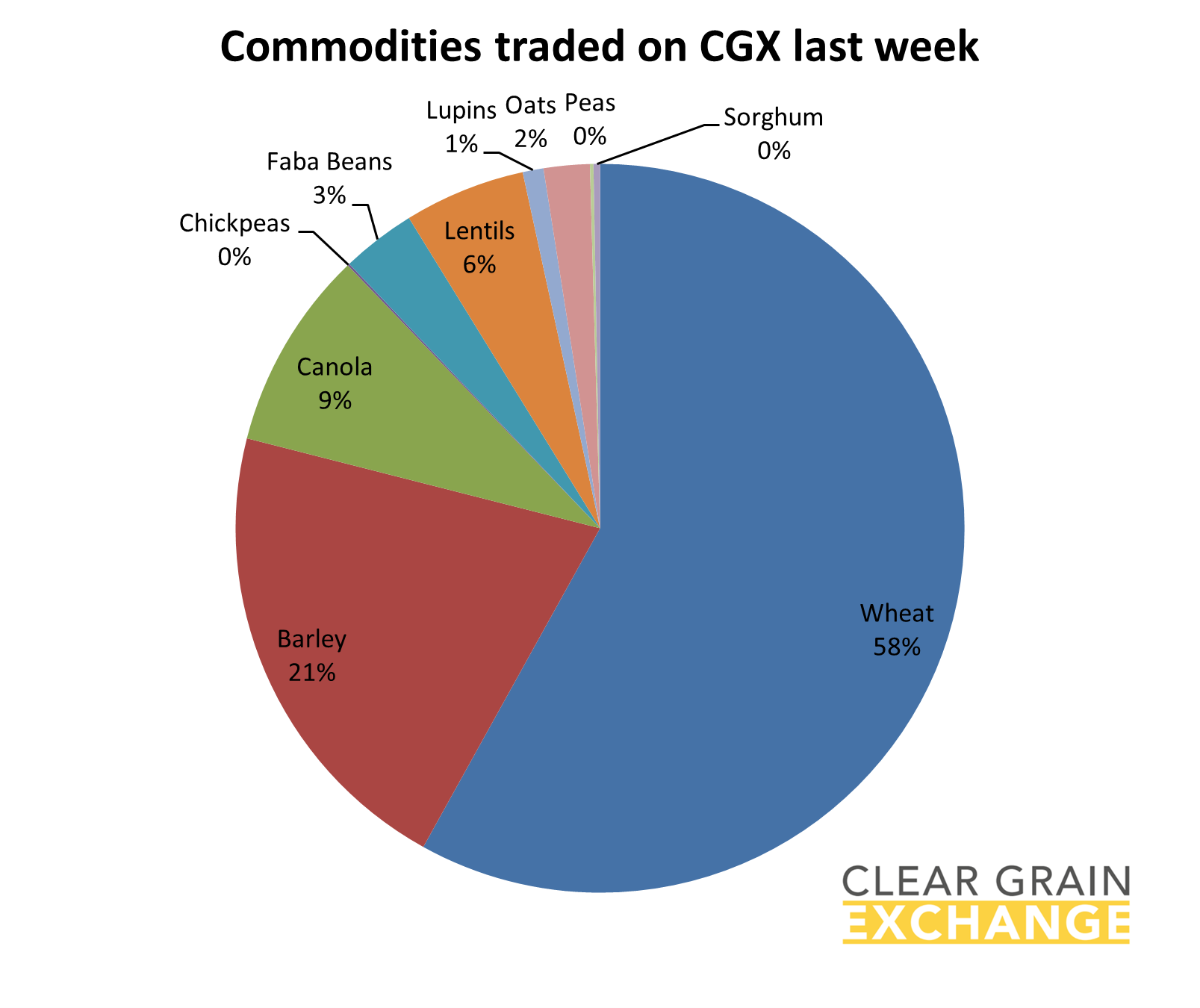

21 in WA

403 sellers sold grain through CGX across 679 transactions - more were offering grain for sale

13 agent and/or advisory businesses sold grain on behalf of growers

49 different grades traded

10 commodities - Wheat, barley, canola, chickpeas, faba beans, lentils, lupins, oats, peas, sorghum

16 port zones traded across QLD, NSW, VIC, SA and WA

Buyer demand lifts early in the New Year

The number of buyers trying to buy grain is lifting early in the New Year.

40 buyers purchased grain through Clear Grain Exchange (grain stored in warehouse) and igrainX (grain stored on-farm) last week.

Additionally, 42 buyers were bidding for grain offered for sale and 111 buyers made 9,120 searches for grain offered for sale.

The lift in buyer interest is generally typical early in the New Year as export programs ramp up and domestic users respond to the shape of the crop's quality to secure what they need.

Demand was wide across a breadth of grades and grains with 49 grades of wheat, barley, canola, chickpeas, faba beans, lentils, lupins, oats, peas and sorghum trading through the exchange at grower target prices.

There are plenty of buyers for Australian grain, demand often lifts early in the New Year after the festive period. Make it easier for all buyers to try and buy your grain.

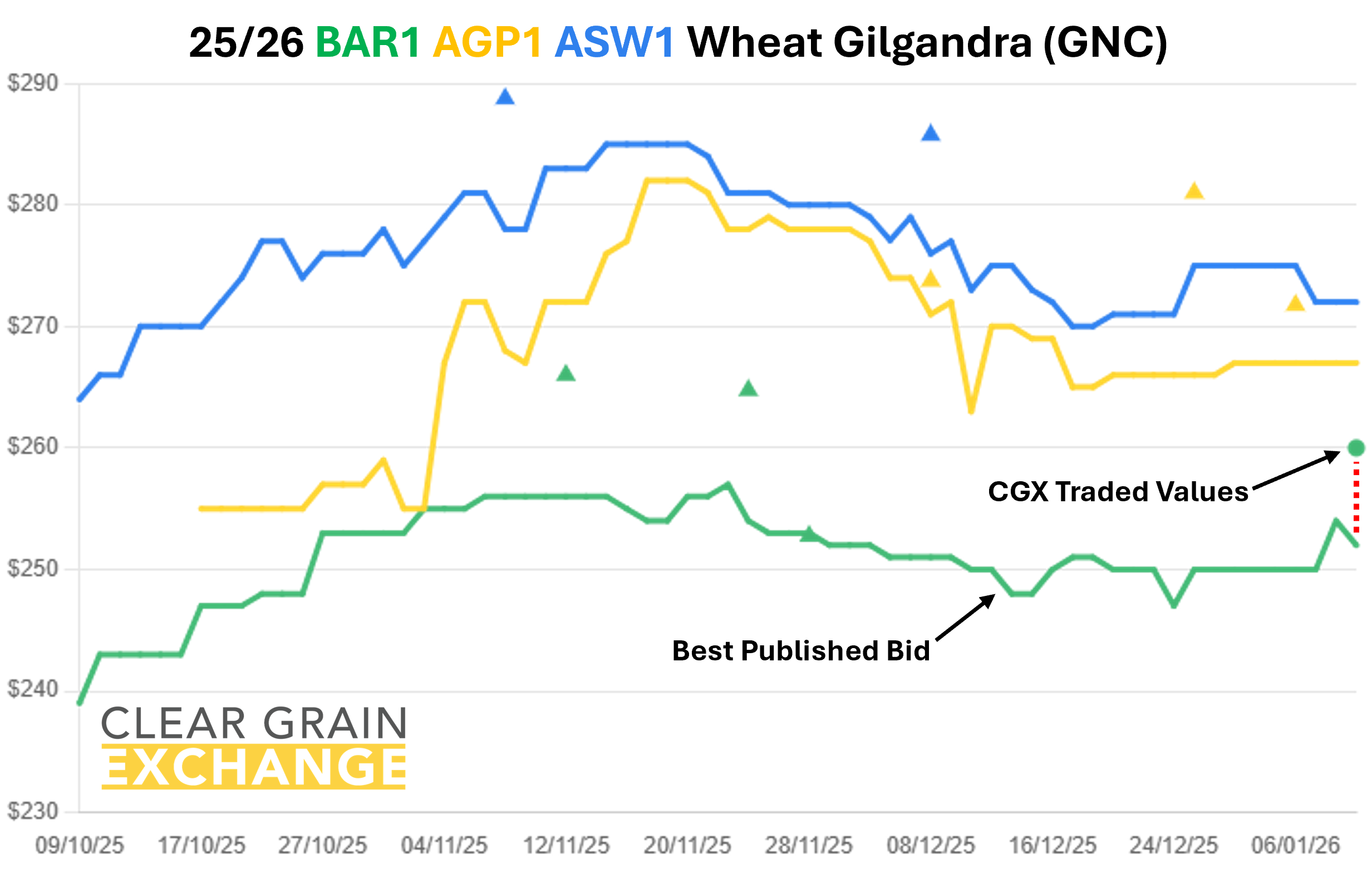

Growers are creating the price opportunities for their grain by offering grain for sale to all buyers at the price they will sell for - it attracts buyer demand and bids.

There are a number of factors to watch that could impact Australian grain prices in 2026 such as relatively tight wheat stocks-to-use and very tight global corn stocks-to-use, geopolitical tensions, declining US winter crop conditions, crop conditions in other parts of the world, and energy prices impacting commodities.

These factors can create volatility in grain prices. Now is a good time to get organised, set price targets, and offer grain for sale so pricing opportunities don’t get missed if they eventuate.

Don’t just offer grain for sale when you're a seller, offer grain for sale when you know prices you will sell for.

Set your price, impact the market, and know that if the market reaches your price it will sell, while enjoying some family time through January.

Regardless of where prices are being bid, growers and their agents can offer grain for sale at prices they're targeting to sell.

Growers are impacting the price of Australian grain by offering grain for sale and leading the direction of all bids.

Your grain can't sell at the price you want if you don't have it out there offered for sale, particularly if you're not watching markets while on holiday.

Growers are logging into cleargrain.com.au, or calling in, to offer grain for sale at the prices they're targeting. Growers using marketing agents are encouraging them to offer their grain for sale on the exchange.

There’s no downside in offering your grain for sale, only upside – why wouldn’t you offer all of your grain for sale at prices you're happy with? Be proactive, take control, and offer.

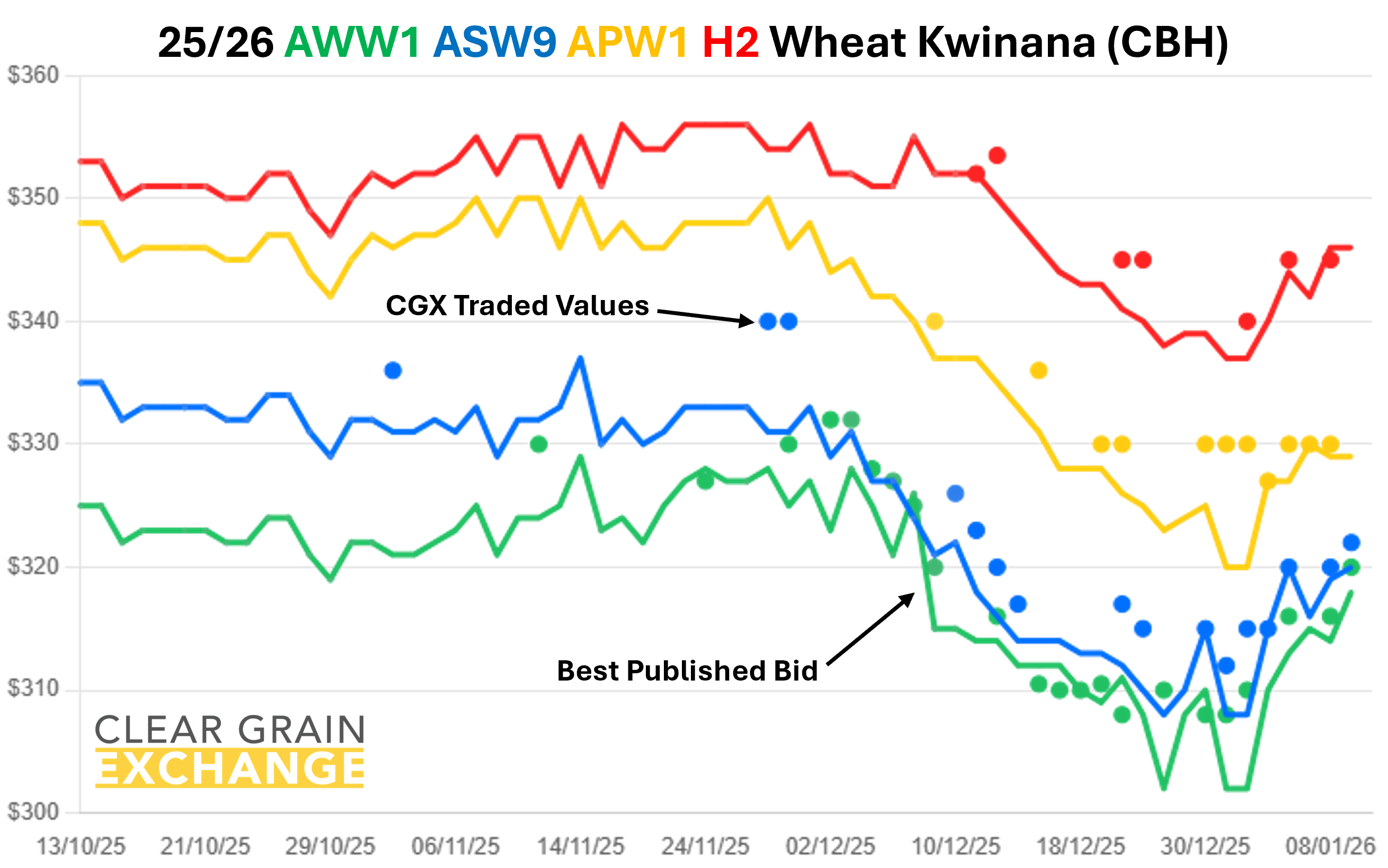

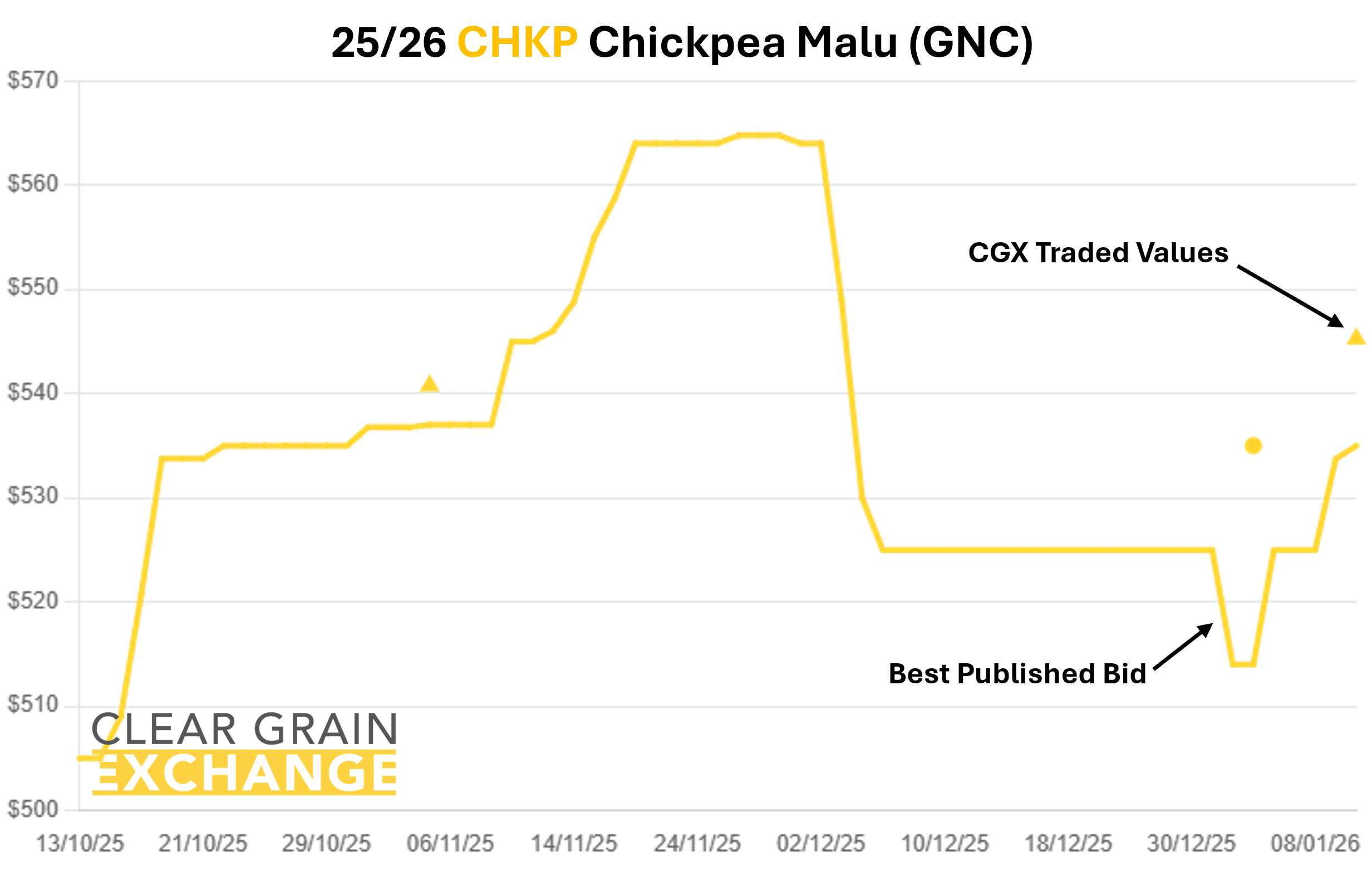

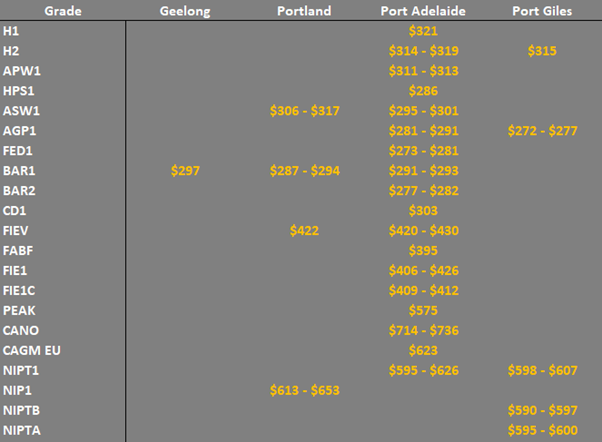

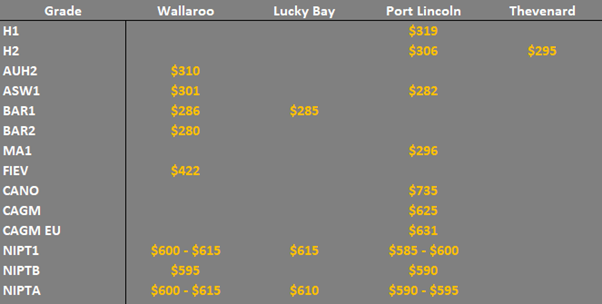

The prices traded through the exchange at a port track (eastern states) or FIS (in WA) level are provided below, but if you're reading this email you will have your own CGX account so login and use it to see what's trading, what's offered, and what's being bid at sites to help you determine the value of grain in your area.

Please call the CGX team anytime for assistance on 1800 000 410.

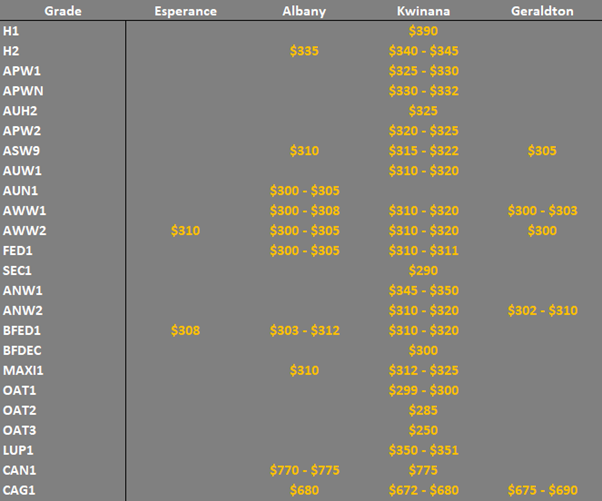

The tables below provide a summary of traded prices on CGX last week

Note: GTA location differentials are used to convert prices to a port equivalent price, actual freight rates can differ particularly in the eastern states. You can offer any grade for sale to create demand.

The charts below provide a summary of grain traded last week

CGX now own and operate the igrainx market for grain stored on-farm

If you have any queries, we're always here to help!

Please give us a call or email if you have any questions.

Call 1800 000 410 or Email support@cgx.com.au