What price do you want for your grain?

Australia’s independent grain report—designed to help support your pricing decisions before the market opens at 10:00am AEST. If you need to change your offer price, simply edit it before market open.

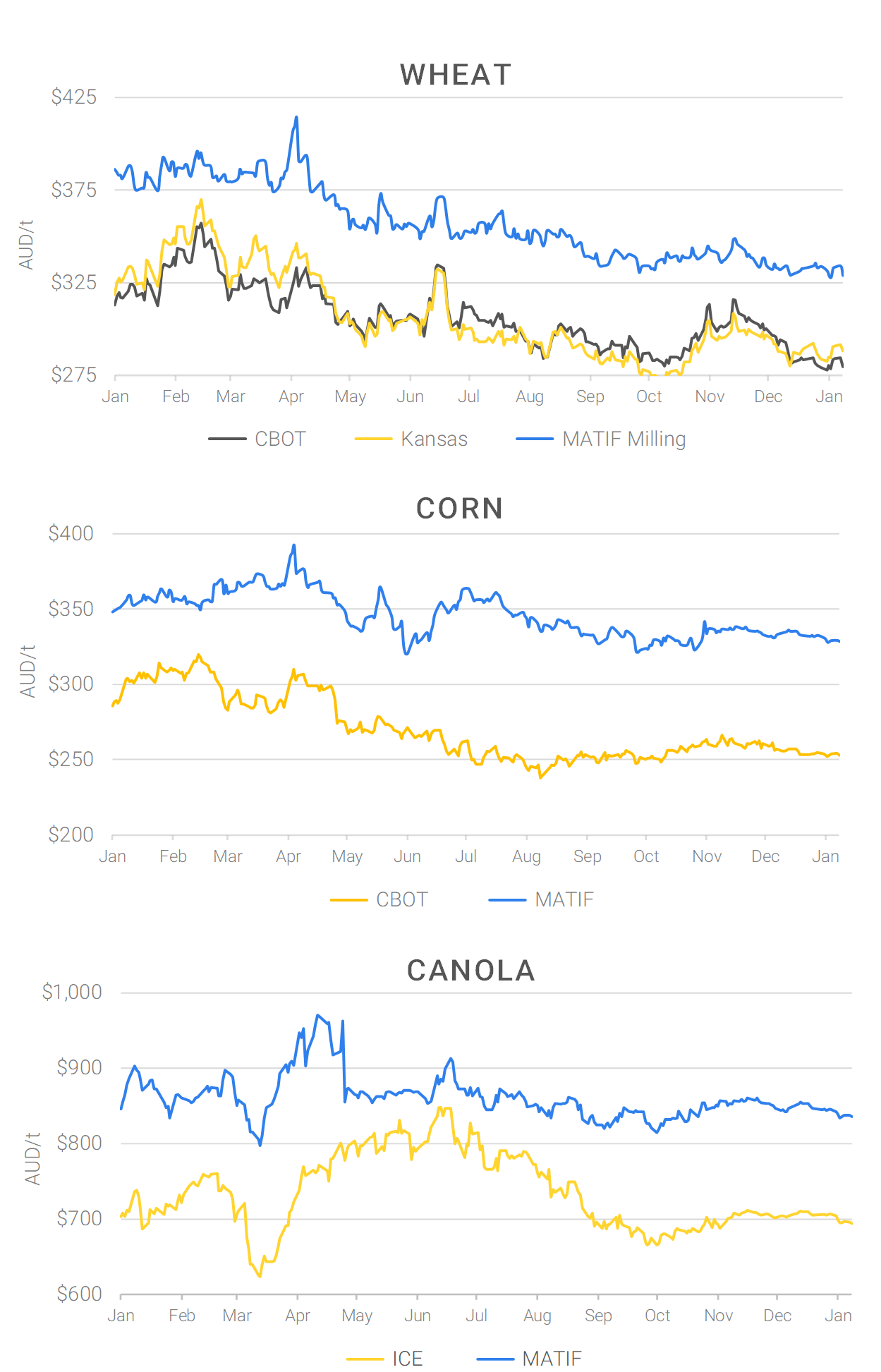

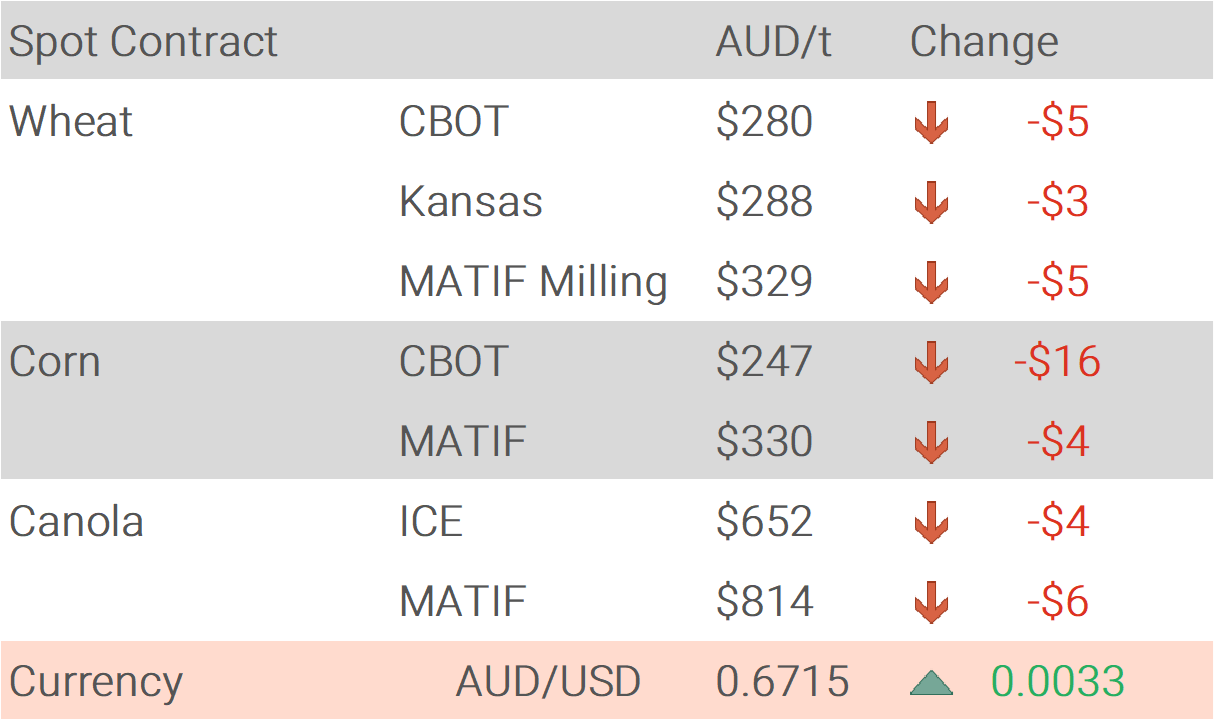

Corn prices crumbled (-5%) after US corn stocks as of December 1 ballooned to all-time highs, after growers last year harvested a record-breaking crop that was bigger than previously expected.

Geez it’s hard to see much support until we start trading new crop winter crop conditions in the northern hemisphere. Old crop production and end stocks estimates continue to rise and reflecting this export markets are extremely competitive. Normally by this time of year Black Sea sales slow but a delayed start to their export season has seen them still very active, despite logistics challenges.

$A bounced back above 67USc overnight as fresh concerns over the independence of the US Federal Reserve undermined the $US. It’s a big week for US data with CPI tonight, producer price index and retail sales Wednesday. The Supreme court ruling on the legality of US tariffs is also scheduled for this week.

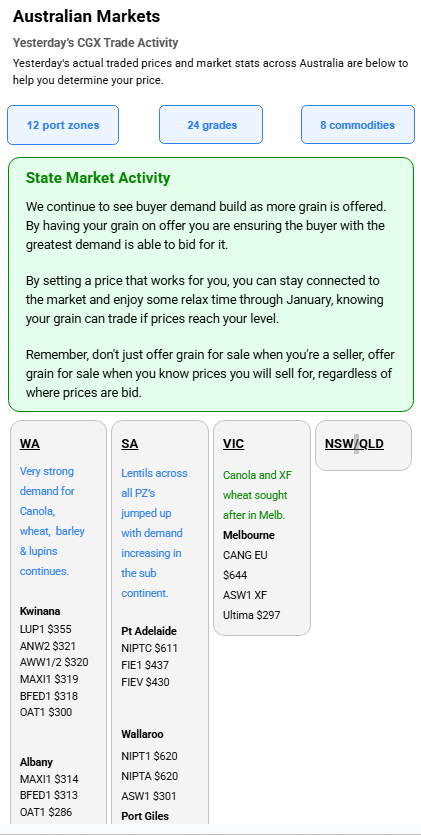

BOM forecast looks much the same with plenty of rainfall for northern half of Australia and more moderate falls in eastern half of NSW/VIC.

Local cereal markets will be under pressure from bearish USDA reports and stronger $A which is starting to nudge up against key resistance at 67.3USc.

For further market commentary please contact the CGX team on 1800 000 410

CGX operates igrainX for grain on-farm

If you have any queries, we're always here to help!

Please give us a call or email if you have any questions.

Call 1800 000 410 or Email support@cgx.com.au